How to Politely Remind Customers About Overdue Payments Without Losing Them

Wouldn’t it be wonderful if every invoice were paid in full and on time? That’s about as likely as winning the next Powerball drawing. Even so, there are things that you, as a business owner, can do to politely and effectively address the issue of late payments with your customers. Believe it or not, getting this job done involves using a mixture of courtesy and modern invoicing tools.

Implement a phased approach

In order to ensure a completed payment and a relationship that remains positive, use a phased approach that starts before the due date, and continues two weeks after and beyond.

The reality is that most customers don’t deliberately plan to avoid paying their bills. Many simply forget to send the check, or click on your payment links.

Instituting a phased reminder progression will help turn procrastination into payments. A few days before the bill is due, send a friendly reminder. Follow this on the actual due date with a polite nudge reminding the customer that the payment is now expected.

One to three days after this, send your first overdue payment message. The tone should remain polite, yet the email should make it clear that the payment is delinquent.

One to two weeks after the due date, send out another notice. Be specific about the number of days that have gone by beyond the due date. At this point, your tone should become firmer.

Beyond two weeks, send your final late payment notice. This correspondence should be firm and precise, indicating potential consequences. In accordance with your initial agreement with the customer, this could involve late fees, a hold on services, or more serious collection procedures.

The components of a polite reminder

At every stage of your contact with a customer, correspondence should contain several elements. These should include a clear subject line, a personalized greeting, invoice details, payment instructions, a call to action, and an offer of help.

Throughout the billing process, it is essential that you maintain a clear and professional tone. At all junctures, the letters or emails that you send should contain several specific details.

Elements must include a clear subject line that informs customers of the purpose of your message. One example might be, “Action required: Invoice 1234 is now overdue.” Additionally, provide a friendly, personal greeting as well as the details of the invoice. Vital elements include invoice number, the original due date, and the total amount due with fees.

Always attach the original invoice, and furnish clear payment instructions. These should specify direct payment links to an online portal as well as a list of accepted payment methods. After detailing what action you are requesting, politely offer help to assist with any aspect of the payment that might be causing difficulties. Finally, close the message on a friendly note.

Additional tips for enhancing your relationship with customers

To optimize your rapport with those late payers, assume good intentions. Focus on the transaction and not the person, set a clear schedule, and consider streamlining your processes using automated systems.

It can be challenging to maintain a professional and friendly attitude, especially if you are waiting for a hefty payment and the client seems uninterested in making it. However, discourtesy on your part can lead to further delays, chargebacks, and even legal consequences in the worst cases.

For these reasons, make it a point to be as polite as possible. Assume that the customer has every intention of resolving their invoice until you have incontrovertible evidence to the contrary.

In your language, talk about the transaction without blaming the person. Instead of “You have failed to pay,” say something like, “Our records show that your invoice is outstanding.”

Additionally, establish and maintain a consistent reminder schedule so that everyone knows what to expect. With most modern invoicing tools and software programs, you can automate your payment reminders. This helps to ensure a uniform experience that requires minimal effort from you.

No matter how hard you try, late payments will never totally disappear from your life as a business owner. However, following these guidelines can help to ensure that they occur infrequently while allowing you to maintain positive relationships with the vast majority of your customers.

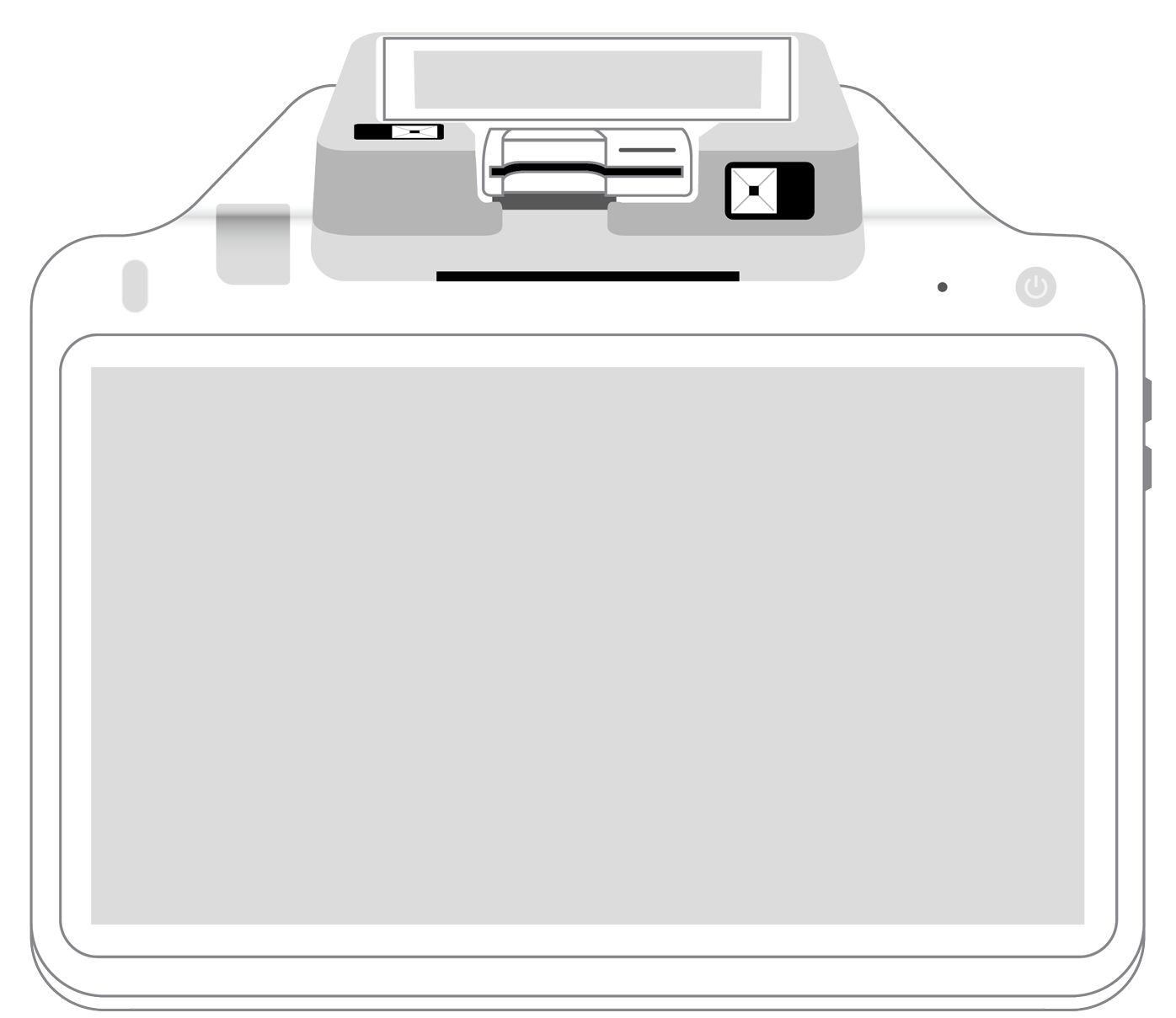

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||