How will credit card payments evolve in the future?

Credit and debit cards are the most popular payment types among American consumers, but the nature of payments has begun to shift in response to changes in technology. How will these changes affect payment processing and what should your business be doing to prepare for the future?

Credit card usage: the stats.

According to ValuePenguin, 67 percent of the American population has a credit card and there are approximately 1.5 billion cards in use across the U.S. The average consumer has 3.1 cards at any given time and uses them to make a variety of different payments.

When surveyed, 33 percent of Americans say a credit card is their preferred way to pay. They’re using plastic the most for online shopping, where convenient checkout methods simplify the purchasing process. Cards are also popular for making travel arrangements online and signing up for recurring payments. Department store purchases account for about 38 percent of credit card use and other purchases are spread out between categories like gasoline, groceries, and dining out.

Although young people have fewer credit cards on average than baby boomers, consumers in the Generation X, Millennial, and Generation Z demographics utilize more of their credit than older age groups. Eighty-three percent of millennials use credit cards to make purchases and a little over a third expect to apply for another card in the near future.

These statistics highlight the importance of accepting credit card payments. Some small business owners still shy away from accepting credit cards due to high processing fees and a lack of infrastructure, but changes in payment processing technology are making plastic and other forms of digital payment more accessible and affordable.

How credit cards have changed.

Believe it or not, there was a time when plastic cards didn’t even exist. Instead, credit cards were once printed on paper. The original multi-purpose card, called Diner’s Club, appeared in 1949 and was shortly followed by a paper card issued by American Express. Throughout the 1950s, cards continued to be issued on paper and included the cardholder’s account number and signature on the front. The first plastic cards, also from Amex, weren’t issued until 1959.

Once plastic appeared, other banks started getting in on the trend. Bank of America pioneered the widespread issuing of plastic payment cards, prompting competing banks to do the same soon after and leading to the rise of major credit card issuers like Mastercard and Discover.

Magnetic stripe cards entered the scene in the 1960s and these remained the standard until some processors began experimenting with RFID technology in the early 2000s. In 2015, the EMV “chip” became standard in an attempt to address growing concerns over privacy and more actively combat fraud.

Now, though, it would seem the stage is set for a revolution much bigger than the switch from paper to plastic or stripes to chips. Mobile devices and virtual assistants are starting to change the very nature of payments and pioneering technologies with the potential to make cards themselves obsolete. As integrations between accounts and devices become more seamless, one-click and touch-free payments are growing in popularity.

About 40 percent of U.S. consumers were using mobile wallet technology by the middle of 2018 and 51 percent of those not yet embracing the trend expressed interest in trying it. With options like Apple Pay and Samsung Pay coming standard on popular mobile devices, it’s possible to check out at many retailers simply by waving your phone over a terminal equipped with near-field communication (NFC) technology. Similar options are appearing in wearables like smart watches, while voice-activated assistants like Amazon Echo and Google Home are making voice payments a reality for many consumers.

Envisioning the credit card of the future.

With all of these changes happening, will the credit cards you and your customers carry even be necessary in the years to come? It’s strange to imagine a time when your collection of little bits of plastic doesn’t overflow from your wallet to a dedicated card holder, but such a day could arrive sooner than you think.

Before this happens, though, credit cards are likely to turn into something like all-purpose “biometric cards” loaded with much more information than an account number. Some card issuers are already testing this possibility, such as Mastercard with its Identity Check. This technology allows cardholders to authorize online payments using facial recognition via a special app and points toward a day when more companies will adopt the face, voice, iris, and fingerprint authentication options now increasingly embraced by consumers. Cards with fingerprint-enabled verification technology are already available from Visa and Mastercard.

If that isn’t weird enough for you, some experts predict a day when credit cards could carry information as detailed as your purchase, health, and financial histories, allowing retailers to tailor discounts and shopping experiences to specific tastes. You could find yourself driving a car with payment options integrated into its dashboard console, an option Visa and Mastercard are already working on with some vehicle manufacturers. Imagine letting your car take care of parking meter payments, gasoline purchases, or even your grocery bill!

Smart appliances show just how bizarre it can be when payments are integrated into daily life. The Family Hub refrigerator by Samsung uses an app from Mastercard to allow families to order groceries directly from the fridge console. Meanwhile, Whirlpool has released a smart dishwasher that has the ability to order more detergent from Amazon whenever the current stock runs low. This is likely to be just the beginning of a wave of monumental changes in the way consumers interact with retailers.

Trends shaping card payments.

What do consumers want? Frictionless payments. People want shopping and paying to be easy and take as little time as possible. Payment processors and card issuers are answering the demand with artificial intelligence, biometrics, and increased integration with mobile and smart devices. This is giving rise to several interesting new ways of paying for purchases, including:

- The adoption of digital payments for physical stores by payment processors like PayPal and Amazon.

- The real-time transfer of funds between businesses and their vendors and customers.

- Popular accounting platforms and technologies that are improving integration with payment gateways.

- Automated accounts payable and invoicing services.

- An increase among vendors in the adoption of advanced payments technology to allow customers to order food and other goods in advance using mobile apps.

- Subscription services and modern billing options, which are enabling more consumers than ever before to embrace automatic payments.

Perhaps the most unusual trend is the advent of the invisible payment, which is just starting to be pioneered by Amazon with its Amazon Go convenience store. Like something straight out of a sci-fi novel, Amazon Go is stocked with grab-and-go snacks in the most literal sense. Hungry, hurried customers scan their phones using the Amazon Go app to gain entry to the store, pick up the items they want and walk out. Every item removed from the shelves is charged to the card they have on file with Amazon. A digital receipt even appears on their phones within minutes of leaving the shop.

Preparing your business for the future of payment processing.

All of these payment trends are enough to make your head spin, aren’t they? However, you don’t have to panic if your business isn’t on board with all these new technologies just yet. The first step is to find out what payment options your customers actually want so that you don’t bankrupt yourself investing in expensive infrastructure you don’t need and won’t use.

If you take your products and services to trade shows or local markets, getting a credit card scanner for your phone makes the most sense. This allows you to accept credit cards wherever you go. Some credit card readers are even equipped with NFC to take payments from mobile wallets. NFC is something to consider for your physical location, too, since one-third of retailers in North America had already adopted some kind of digital payment technology by the end of 2017.

Integrating payment options with a credit card processing app linked to both your mobile device and your in-store POS system unifies the shopping experience for your customers and takes the confusion out of managing budget and inventory. Management becomes even easier if you choose an option designed to deliver payment information as soon as purchases are made, while pairing with your accounting software.

While many emerging payment technologies still require refinement before they’ll be ready for universal adoption, it’s smart to begin preparing now for payments industry changes that are coming in the near future. The reality is that consumers are eager to adopt new technologies that make payments easier and shopping more convenient. Therefore, the businesses who will be able to offer streamlined experiences are most likely to come out on top.

Familiarize yourself with the future of credit card payments and start making the necessary changes to equip your business to accept the payment options your customers desire most!

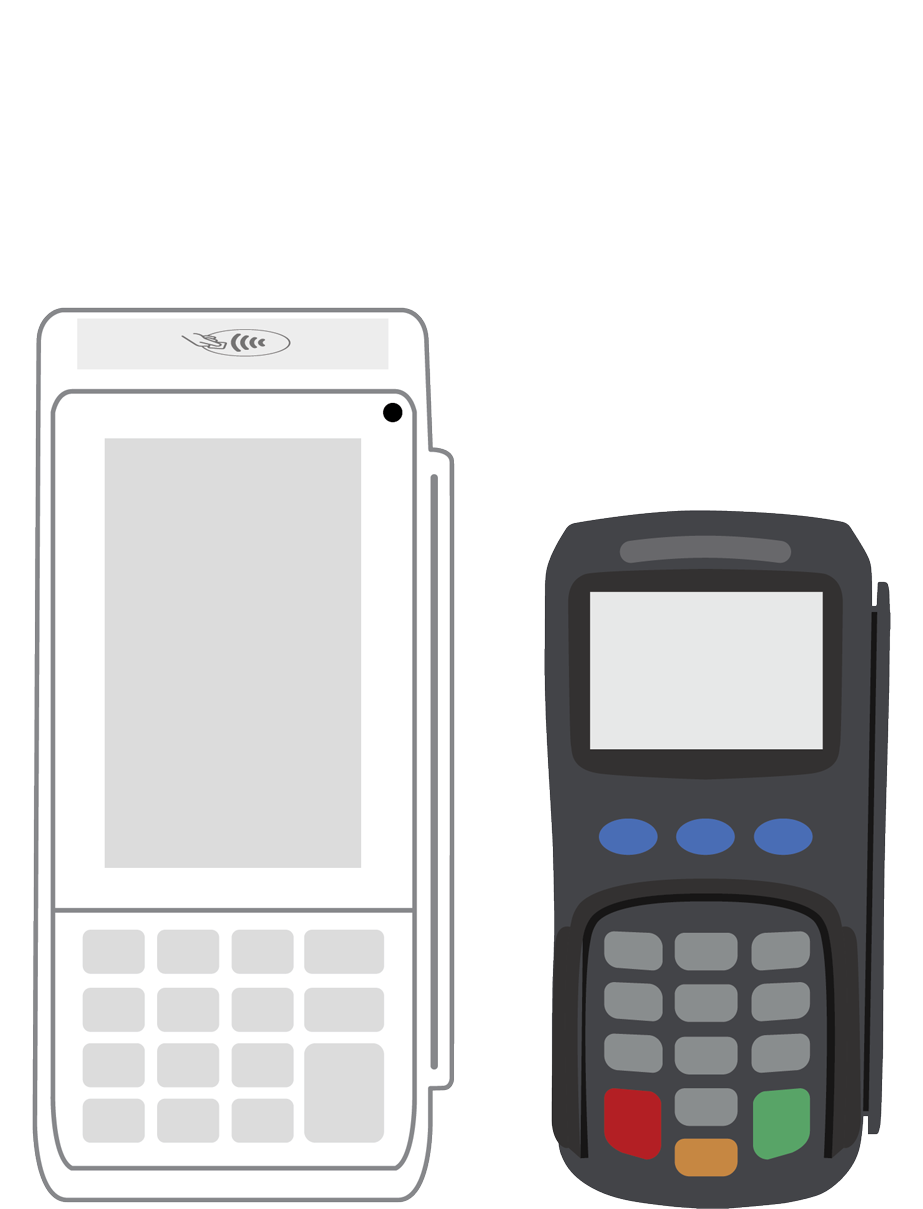

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||