Seven different types of mobile payments explained and how they can benefit your business.

The smartphone (as well as the various pieces of technology associated with it) have revolutionized numerous aspects of our everyday lives. One of the most significant has to do with the ways that consumers shop and pay for the goods and services they buy. Once you see just how many types of mobile payments exist and how efficient and secure they are, you will want to incorporate some or even all of them into your business model.

1. Near-field communication (NFC) payments.

In recent years, the popularity of so-called touchless payments has skyrocketed, due in part to the global pandemic. As concern over contracting germs and viruses via physical contact with people and surfaces ballooned, buyers and sellers alike embraced payment solutions that took advantage of the NFC capabilities in merchants’ card readers and consumers’ smartphones. With NFC contactless payments, payment information can be transmitted securely back and forth between these devices within a matter of seconds. Best of all, the entire process can be accomplished without there being any physical contact.

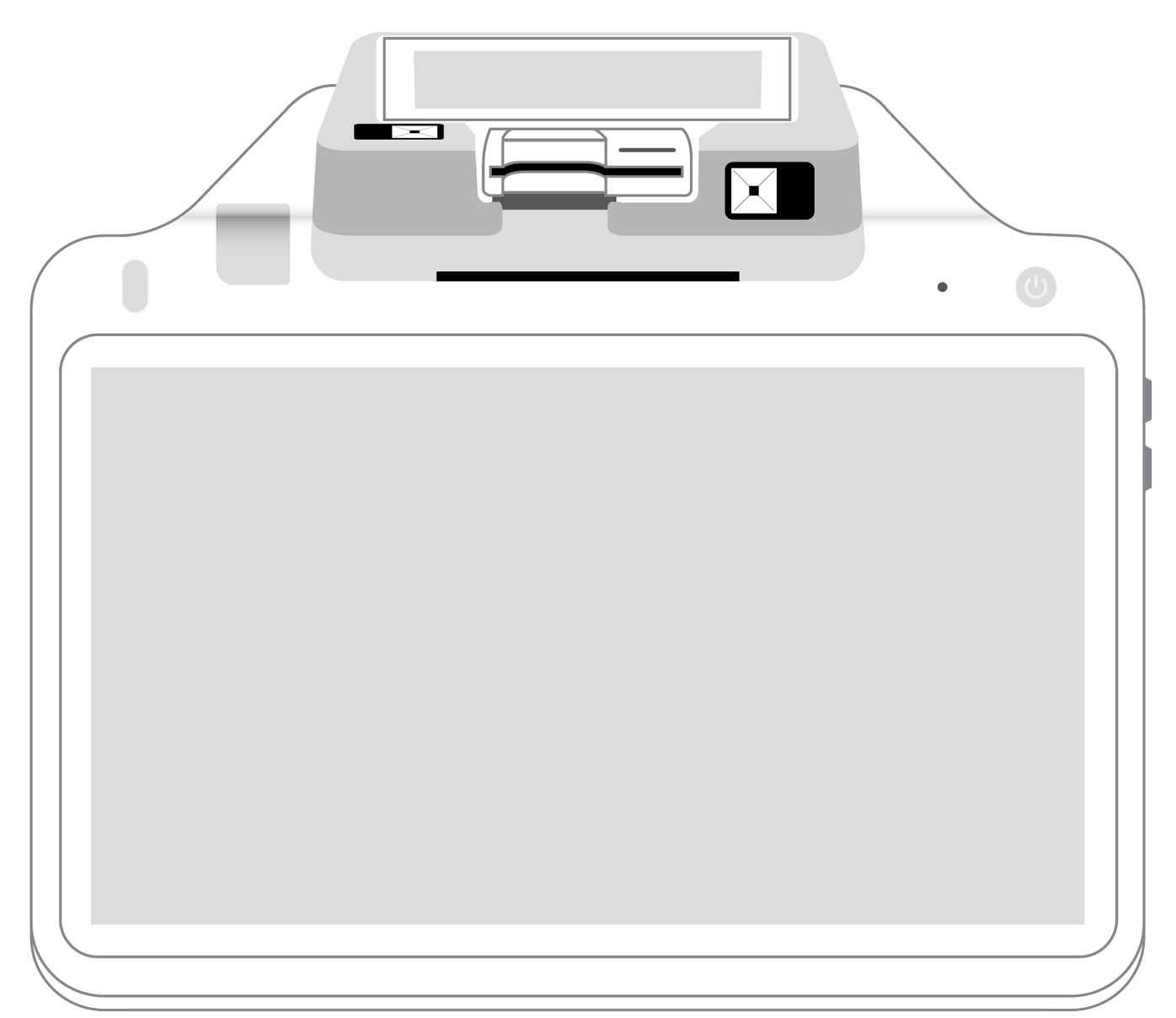

Incorporating an NFC-equipped mobile Bluetooth card reader into your payment system can benefit both you and your customers. Patrons will see that you have both their safety and convenience in mind. At the same time, you’ll both leverage high levels of speed, security, and flexibility throughout the consumer payment process.

2. Mobile wallets.

A mobile wallet functions as the digital counterpart to the physical card and money carrier that customers traditionally placed in their purse or wallet. Built into both Android and Apple smartphones, this is a secure storage repository where customers can input their credit and debit card information, as well as details from loyalty cards and transit passes. After the data is added and verified, it is encrypted for safe storage, available at any time the owner wants to make a purchase. The wallet can even be linked to Apple Pay, Google Pay, and Samsung Pay.

Upon arriving at the checkout counter with the products they want to buy, the customer simply opens the digital wallet on their smartphone and places it within one to two inches of the merchant’s NFC-equipped card reader. The person’s identity is verified with a fingerprint or facial ID. The data is then sent to the payment processor and the customer’s bank for verification. If all is in order and there are sufficient funds in the account to support the transaction, word of its confirmation will be relayed back to you in a matter of seconds.

Accepting NFC-based digital wallet payments provides your customers with maximum convenience and flexibility during the purchase process. As cash becomes less popular, it is in your best interests to give buyers as many buying alternatives as possible. Since most people rarely leave home without their NFC-equipped smartphones, it stands to reason that accepting digital wallet-based payments should be at the top of your payments priority list.

3. Quick response (QR) code payments.

The black and white square barcode design of QR codes can be seen virtually everywhere these days: on TV screens, in stores, and on food menus at restaurants. Smartphones equipped with downloadable scanning apps can easily read the information contained in these barcodes. One of the many popular applications for QR codes is in the mobile payments arena.

Perhaps the most common way for a QR code to be processed is via a customer’s smartphone. First, the seller specifies the total transaction amount in their point of sale system. The buyer’s phone displays a unique QR code that is tied to the payment information stored in their digital wallet. The buyer then simply opens their phone’s camera or QR code app to scan the code that is displayed on a product, a paper bill, or at the checkout counter. The retailer concludes the transaction by scanning the customer’s QR code.

Adopting the use of QR codes can benefit your business in several ways.

- Fast payments. Within seconds, the consumer can open the QR scan app, scan the QR code on the product, and press “confirm.” Transacting the payment is both simple and convenient.

- Higher security. All data exchanged during the QR code payments process should use certified, point-to-point encryption and tokenization, making hacking highly unlikely.

- Easy setup. You don’t need to buy expensive or complicated POS equipment for these types of payments. All that is required is a QR code and a smartphone that is equipped with a camera and a scanning app.

- Error-free. Because manual data entry is not involved, QR payments eliminate human mistakes.

- Affordability. QR code payments involve very little cost and minimal setup and maintenance for you while simultaneously giving your customers an easy and safe way to pay for the goods and services they want.

4. Internet payments.

We often think of the smartphone in terms of its role as the holder of the digital wallet. However, it also facilitates online shopping and the completion of payments via internet browsers such as Chrome and Safari. Payments via a smartphone can be made in several ways.

- Manual entry of credit card and other payment details using a cellphone on your website via a payment gateway.

- Use of your mobile app, with the payment being processed via an attached bank account or credit card.

- Paying via a third-party vendor such as PayPal.

- Following a link in an email, text message, or over social media to a digital invoice. Once the recipient clicks on the link, they are taken to a checkout page onto which they can enter their payment details. While the payment amount is often set in advance by you as the merchant, there are also cases such as making charitable donations in which the customer can specify the amount to be paid.

5. SMS payments.

With this type of transaction, the payment is made using a text message. After the customer submits the text containing the relevant payment details, the amount is added to the customer’s mobile phone bill. Although this form of payment is still common in certain parts of the world, other methods have gained greater traction in recent years. All the same, offering this as an option to your customers is especially helpful if your clientele is less likely to have credit cards or a consistent bank account.

6. Direct carrier billing.

Similar to SMS payments, this method is especially suited to customers who prefer to pay through their mobile phone carrier instead of by providing a bank or credit card account. The customer enters their phone number on a payment page or in an app and verifies their identity by confirming a text message. The specified payment amount is then deducted from their prepaid card or added to their mobile phone bill. This form of payment is often used for digital subscriptions, voting, and charitable donations.

7. Peer-to-peer/mobile banking.

As cash becomes increasingly scarce, consumers are finding other ways not only to pay merchants but also to transfer funds to each other. Dedicated apps like Venmo and PayPal are excellent vehicles for these activities. So are apps from banks and other financial institutions. Often, consumers are also using these methods to pay small business owners such as contractors, manicurists, and child-care providers.

Just a few decades ago, paying for goods or services was usually accomplished with cash. Checks or layaway plans were often used for bigger-ticket items, although even then credit had its place. In recent years, however, the entire payments landscape has been totally transformed.

As a 21st-century business owner, it is vital that you take a long look at the many payment options that your competition is already embracing. Modern customers know what products they want and they are equally certain that they are entitled to have a wide range of payment options at their disposal. If you fail to provide both in your physical or online store, one thing is for certain: Your rivals will gladly jump in to provide your would-be buyers with the goods and customer experience they are looking for.

Don’t wait until your profits start to dwindle. After taking time to research who your customers are and how they prefer to pay, do what it takes to bring expanded mobile payment options into your retail business. Doing so will help you take your business wherever you want it to go.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||