The 10 fundamentals of successful small business invoice design.

Twenty-seven percent of small and midsize businesses (SMBs) have a hard time creating and sending invoices, which directly impacts cash flow and customer relationships. Proper invoice design establishes a clear record of every sale you make and helps keep finances in order by facilitating faster payment.

Invoice payment issues plague small businesses.

Late invoice payment is a big problem for small business owners. About 64% of SMBs get paid late, while 49% have trouble following up with delinquent customers. 13% of all invoices aren’t paid on time and up to 10% are either never paid at all, or paid so far past the due date as to qualify as bad debt.

The economic impact of this late payment epidemic amounts to a staggering $3 trillion per year worldwide for SMBs. Slow payment affects a company’s ability to invest in new equipment, maintain consistent marketing, pay current salaries, and hire new employees.

What if the difference between perpetual cash flow problems and getting paid on time was as simple as changing the way you write invoices? Crafting a document your customers can easily read, understand, and pay has the potential to change everything about your invoicing and payment process.

10 invoice design fundamentals.

Customers should see several key elements when they open your invoices. Include these 10 basic details to clarify purchase information and accelerate payment.

- Business name and logo.

- Contact information.

- Customer information.

- Invoice date.

- Invoice number.

- Line-by-line charges.

- Purchase order number.

- Payment terms and due date.

- Payment options.

- Additional notes.

Starting your invoices with a custom header shows recipients who issued the document and increases brand recognition. With every invoice you send, you make an impression with the potential to generate more sales in the future. Customers who don’t know much about your company may be prompted to learn more by visiting your website, making a call, or requesting a complete catalog of products and services. Including your business name and logo on communications is also important because customers doing business with multiple companies may need to be reminded of where they’ve placed orders.

Make it as easy as possible for customers to contact you by placing your business address, phone number, email address, and social media handle in a prominent spot on all invoices. Adding contact details right below the logo draws attention and lets customers know you’re available to answer questions or address concerns about orders.

It is customary to include the name, address, phone number, and other contact details of the customer receiving the invoice. While this may seem like a formality, it can speed up payment by ensuring the invoice gets to the right person for prompt processing. An email address may be all you need when issuing electronic invoices, but you should also have a full physical address on file for sending hard copies of documents in the event an invoice goes unpaid.

Proof of when you sent an invoice is important. Not including a date can be confusing for your customers, particularly those receiving stacks of invoices every month. Businesses and individuals tend to prioritize the most urgent payments and your invoice may not be considered as important as others if there’s no date to indicate when it was issued.

If you’ve agreed to specific invoice terms, such as the customary “net 30,” the date establishes the start of the terms and alerts customers when payment is due. Dated invoices also serve as reminders and confirmation of when an order was placed or services were rendered and are easier to keep track of when filing paperwork and preparing taxes.

A numbering system simplifies invoice tracking and record-keeping, so choose a system that you can stick with and easily remember. As long as it makes sense to you, you’re free to get creative with the way you number your invoices. Some business owners use plain labels like “Invoice #001.” Others include customer information with the numbers to differentiate between groups of invoices.

If you issue a lot of invoices, you may want to categorize them using the names of each month along with numbers. This is a particularly useful system for keeping monthly sales data organized so that you have everything you need in one place come tax time.

Have you ever seen a charge on your credit card statement and had no idea what it was for? Customers feel just as confused when you don’t itemize your invoices. Breaking orders down and listing the specific charges for each item lets customers know exactly how much they’re paying for your goods and services, as well as any additional taxes and fees.

When creating your invoices, list each product or service on a separate line along with the base price, quantity, and total price. Record a subtotal of all charges before calculating tax and applying any promotions or discounts. Add shipping charges, if applicable, and label the final total as “amount due.”

None of the charges should come as a surprise to customers, but if they have questions, you can refer to the detailed breakdown to clear up any confusion.

Some sales may have corresponding purchase order (PO) numbers, which you should include on the invoice. Making it easy for customers to check invoice details against POs can lead to faster payment. When an invoice is received, the customer can simply match the PO number to the original purchase order document and compare the order with the items on the invoice to confirm all charges are correct.

Payment terms should be conveyed in advance and included on all invoices to remind customers of their payment obligations. List any upfront deposits or prepayments that may be required for each order, along with information about both early payment discounts and late fees.

Include the due date along with the terms in large enough print to catch the customers’ attention. Don’t assume customers will remember the date or figure it out using the invoice date and terms. The clearer you are, the more likely you are to get your money on time. Printing the terms on the invoice gives you recourse if customers pay late or don’t pay at all.

Offer multiple ways to pay so that customers can choose the payment method they are most comfortable with. Popular payment types differ depending on your industry and target demographics, but you should at least equip your business to accept credit cards and online payments. Adding an online option increases the likelihood of payment by 30% and should also enable you to offer autopay for recurring orders. Compare payment service providers to find a platform that accepts the payment types most relevant to your target audience. Then, list all payment options on the invoice.

A personal touch transforms a standard invoice into a conversation between you and your customers. Express your gratitude with notes thanking customers for their orders and consider including incentives to bring them back. Recognizing customers and demonstrating appreciation with discounts or promotional items shows customers your company cares about their business and wants to build a lasting business relationship with them.

Tools for better invoicing.

Designing and sending professional invoices doesn’t have to cost a small fortune. You can get started with one of the many free templates available online or sign up for a cloud-based invoice solution. If you use accounting software or a full-featured point of sale (POS) system for your business, check to see if you can integrate a separate invoice platform or if they already have tools for generating invoices.

Some small business invoice solutions have no monthly fees and only charge you for processing payments. Whether you choose a free or a paid platform, you benefit from:

- Adding products, services, and customer profiles to a database to use for future invoices.

- Detailed sales histories.

- Faster invoice generation.

- The ability to offer multiple payment options, including recurring payments.

- Options to automate invoice delivery and send payment reminders.

Tracking tools offer the details of every sale and invoice at a glance, which makes it easy to review invoice statuses and send follow-up messages to clients who haven’t paid. When you log into your invoicing platform, you should have all the information you need to file taxes, assess your profitability, and make financial projections for the future.

The right tools and design elements speed up the invoicing process and bring in more on-time payments. When you get your money on or before the dates invoices are due, cash flow begins to normalize and budgeting becomes less of a headache. Start making adjustments to the way you design and issue invoices and watch your business start to thrive.

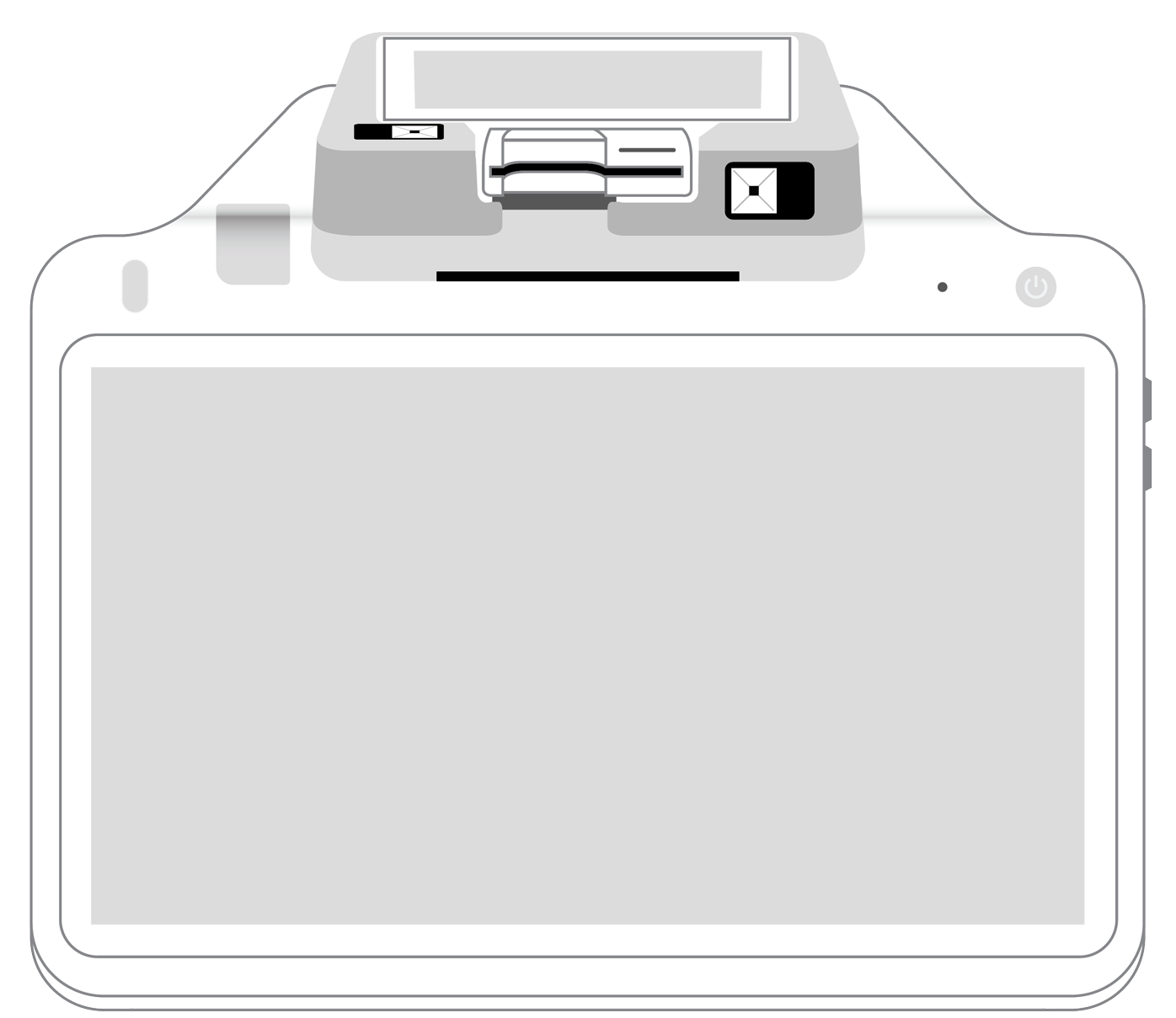

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||