The Cost of Not Accepting Mobile Payments

While use of mobile wallets like Apple Pay and Android Pay is increasing, it is still a fraction of overall retail sales. This has led some retailers and merchants to believe that installing the technology to accept mobile payments may be a waste of time and money that could be spent elsewhere. What these reluctant merchants need to realize, is that they could be alienating a large portion of their future customers.

Mobile wallets are tied to credit card accounts, which have been on the rise for some time. New credit card issues were up 11 percent in the second quarter of 2016, compared to the second quarter of 2015. In numerical terms, there were nearly 85 million new credit accounts opened in the second quarter, and they are ready to shop. But while these new accounts can be used with mobile wallets, many are not doing so, at least not yet. And that is the key – “not yet.”

The millennial generation is one of the largest to come along since the baby boomers, and they’ve got spending power – with the oldest millennials now reaching their mid-30s they will be a purchasing force to reckon with for years to come. Millennials are the first truly digital generation, having been born into a world that has always included cable TV and cordless telephones, and being too young to remember a time without home computers, cell phones and the internet. They are early adopters – people who are the first to try out new technologies – and as a result, they have experimented with mobile payments in large numbers. Many experts believe that while credit cards are not in danger of being displaced by mobile payments in the immediate future, their use is certain to increase, and millennials will be leading the way. Failure to recognize this now, even if the technology won’t be in widespread use for several years, could result in the alienation of millennials, who are using mobile payments more than any other demographic. That could be a steep price to pay, as most of them have not yet reached their prime spending years and are likely to have the most spending power of any demographic group for the foreseeable future.

But currying favor with millennials is not the only reason merchants should consider updating their POS systems to handle mobile payments. Of course cost can be a big issue, and for some of the smaller merchants, the cost is potentially prohibitive. But there is also the potential of lost business, not just with millennials but with all customers, as mobile payments often come with additional capabilities that can be added to the system, such as loyalty and rewards programs that can aid in customer acquisition and retention. Also, accepting mobile payments will give consumers the perception that the merchant is a forward-thinking, modern business owner who isn’t afraid to try new things. This image of appearing cutting-edge and progressive can give merchants a leg-up during times of fierce competition, such as the holiday season, and can help attract customers.

For those merchants concerned about how much money it will cost to install mobile payments acceptance ability, it depends on whether or not the POS system in place has been upgraded to accept EMV embedded-chip credit and debit cards. EMV POS devices tend to have NFC (near-field communications) capabilities already installed, which is needed for customers to use their mobile wallets at checkout. It may be as simple as turning on a function of your card reader, but even if it’s a little more involved, it should still be a relatively small task with little to no expense.

One thing to keep in mind, though, is even if mobile payments take over all other forms of payments in terms of popularity at some point in the future, credit cards – and even cold, hard cash – are still likely to have a place at the table. “No form of payment has ever gone away since the invention of currency, and cards are the payment standard right now,” says Thad Peterson, an analyst with the Aite Group. “They work and people understand them. Mobile will take its place in the payments ecosystem, but it will be a while and it’s likely that cards and mobile will co-exist for some time to come.”

Related Reading

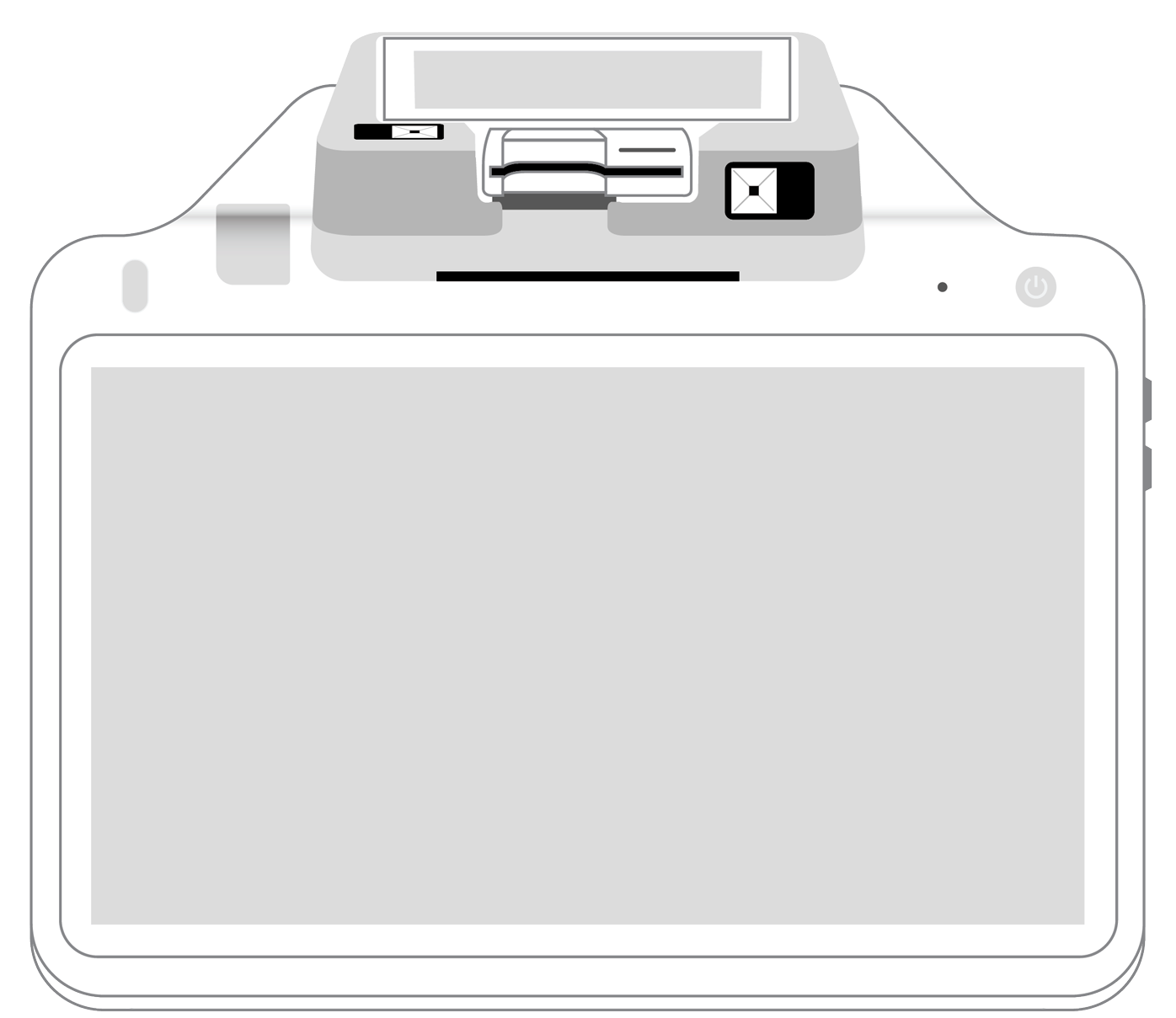

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||