What is EMV?

EMV is here, and it isn’t going way. Do you know all you need to know in order to successfully offer EMV transactions at your business? Here are 5 common questions and answers about EMV, courtesy of MasterCard:

EMV is here, and it isn’t going way. Do you know all you need to know in order to successfully offer EMV transactions at your business? Here are 5 common questions and answers about EMV, courtesy of MasterCard:

1. What is EMV?

EMV is a global industry standard that is used to govern chip card payments and acceptance devices like POS terminals, kiosks and ATMs. Europay, MasterCard and Visa developed the standard, originally. According to MasterCard, cards with EMV chips embedded in them provide strong security features and other capabilities.

2. Where is EMV used?

MasterCard states that more than 80 countries, worldwide, support EMV chip card payments. These countries include Canada, Mexico and several countries in Europe. The United States is the last major country to adopt EMV standards.

3. When do I need to have my business EMV capable?

According to MasterCard, if you install EMV capable card readers with PIN support by Oct. 1, 2015 you won’t be held liable for fraudulent transactions (lost, stolen or counterfeit). If you do not upgrade your terminals or equipment by Oct. 1, 2015 then your business will be held liable for potential counterfeit, lost or stolen fraudulent transactions made with EMV chip-enabled cards. Only fuel dispensers at gas stations are exempt from the 2015 deadline. Instead, they have until Oct. 1, 2017.

4. Why should I accept EMV cards?

EMV chip cards are harder to clone or steal data from. MasterCards states that merchant terminals capable of processing both contact and contactless EMV chip payments allow for more secure and faster checkout experiences for customers.

5. How does EMV secure transactions?

The chip embedded into the payment device is a mini computer that performs additional security checks during the validation of a transaction, according to MasterCard. Using dynamic data, the chip makes each transaction unique. This is different from a traditional credit card that uses static data and never changes – making it easy to replicate.

Related Posts:

Related Reading

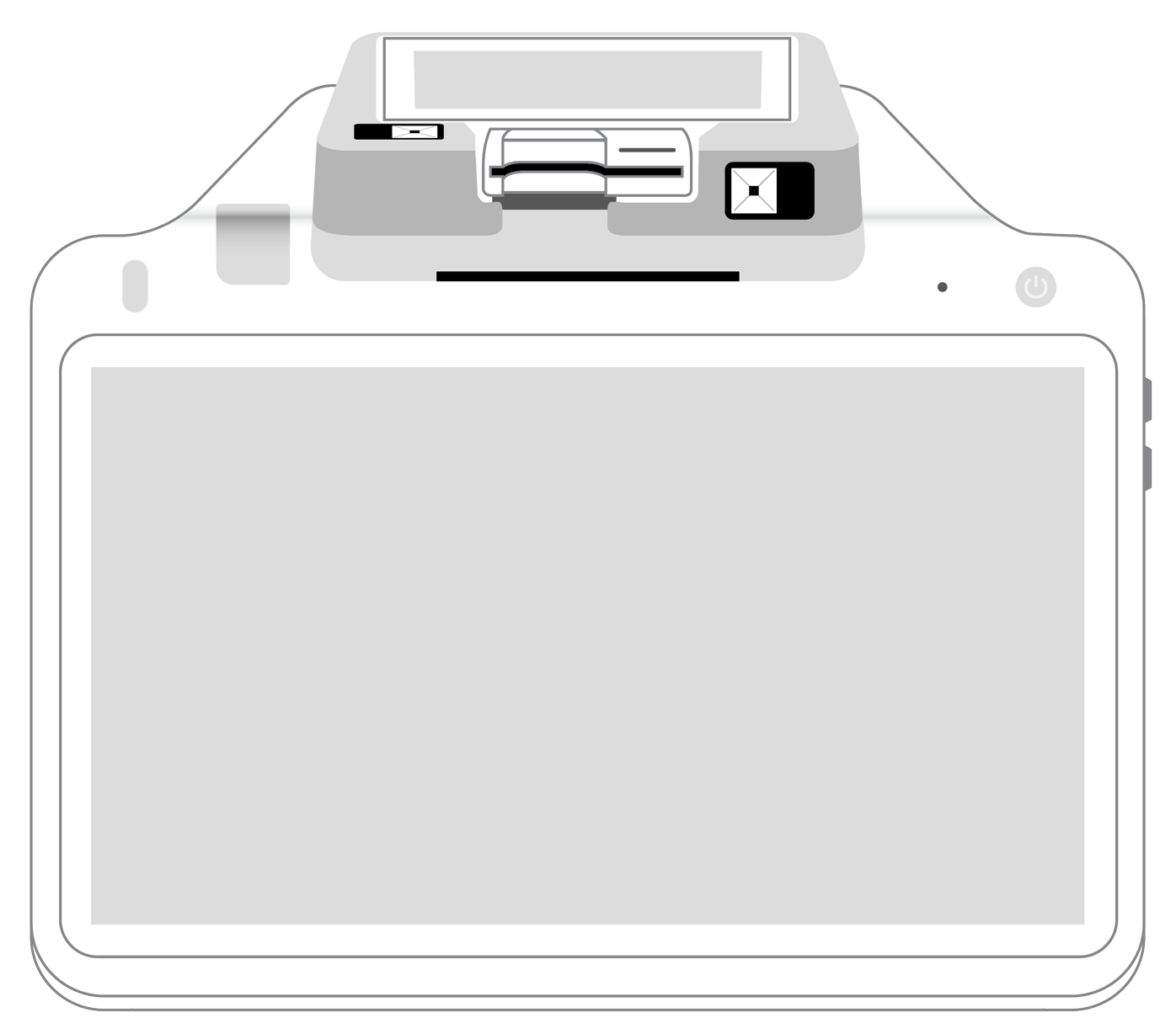

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||