What Is next day funding and is it right for you?

As a business owner, you are no doubt quite aware that cash flow is king. You need capital to pay for the space you rent, the products you stock, and the employees you hire, and that is just the beginning. Getting the money you are owed as fast as possible can enable you to make necessary purchases, and pay your creditors in a timely fashion. For many entrepreneurs, next day funding provides a viable solution, but is it right for you?

Next day funding defined.

Bank-to-bank or ACH transfers typically take two to three business days to complete. This time lag can pose some real cash flow problems, especially for retailers who conduct a lot of credit and debit card transactions.

However, next day funding enables a merchant to get their money in a matter of hours. Generally, if you settle your batch before the 10:30 p.m. ET cutoff time, the financial institution will deposit funds into your bank account the next business day. If the request is made on weekends, the money will show up first thing Monday morning.

Benefits of next day funding.

As you might guess, having faster access to your money gives you freedom to take actions you might not otherwise be able to accomplish so quickly. Since there are no limits to batch sizes, you don’t have to undergo the hassle of delays, and double-checking amounts. In most cases, you don’t even need to make any changes to your software to enable next day funding; the functionality should already be integrated into your payment processing software.

Another upside of next day funding has to do with what it can do for your accounting department and procedures. Faster access to your money means that you can close out accounts with vendors at an expedited pace. In the end, that leads to smoother business relations, and perhaps even a financial savings for making early payments.

Disadvantages of next day funding.

In spite of its ease and convenience, next day funding has a downside. It is not as fast as same day funding, which ensures that you receive your money just a few hours later on the same day as long as you settle your batch by 10:30 a.m. ET.

Merchant account providers need a small amount of time to ensure that none of your payments are fraudulent or otherwise represent additional risk to them. That said, given the options available these days, waiting longer than the next business day to receive access to the fruits of your hard work no longer makes any sense.

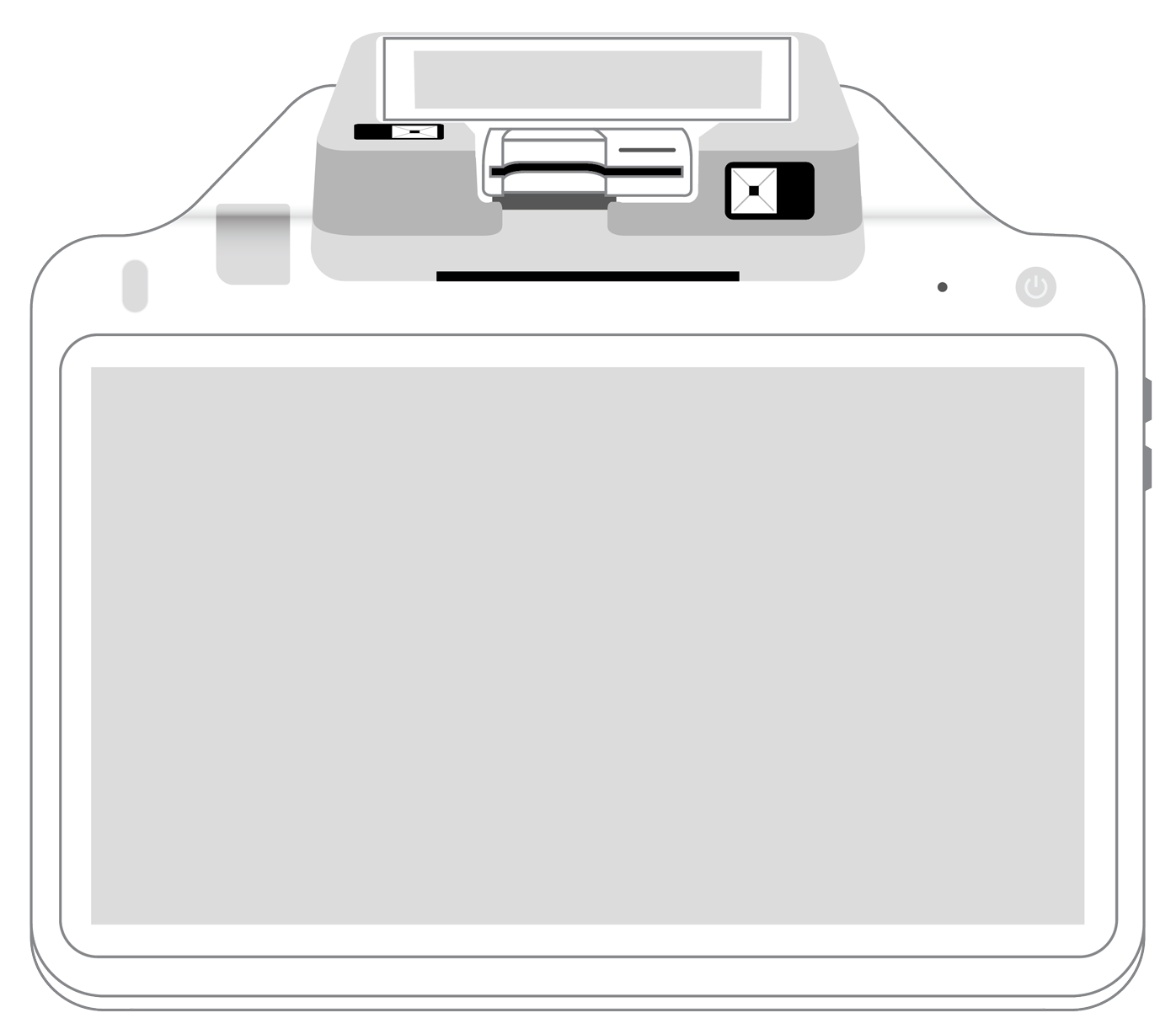

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||