3 reasons the U.S. is behind other countries in contactless payment adoption.

Here in America, we pride ourselves on how exceptional we are. With that in mind, how can the nation that was first to send a man to the moon, the country that invented the assembly line, and the combustion engine, be so slow in accepting contactless payments? There are several reasons why the U.S., home of Apple Pay and Google Pay and headquarters of the three major card brands, has been delayed in adopting touchless payments via digital wallets and chip-equipped credit cards.

Initial difficulties.

When Mastercard and Visa first rolled out their respective contactless Masterpass and PayWave products in 2002, they spent millions of dollars on the necessary equipment. As a result, each card cost issuing banks as much as an additional $10, which made many of them reluctant to spend the requisite funds. This started a downward spiral in which cards were hard for consumers to obtain and merchants became reluctant to spend the money to change over their equipment. In the end, contactless options seemed to be doomed to the same fate in the US that the metric system had suffered.

The dominance effect.

In a way, it was the U.S.’s predominant position that blinded consumers and financial institutions alike to the many benefits of touchless payments. The fact that the major card companies and banks were headquartered in the United States may have made them reluctant to leave their comfortable, established ways for a realm that may have seemed tenuous and faddish. The thinking of payments executives might have gone something like this: “Even if big players like Australia have touted the efficiency and security of contactless payments and switched over to them, we certainly don’t need to go through all of the angst involved in conversion here in this world-class arena.”

Missed opportunity in 2015.

In 2015, all U.S. credit card companies began providing customers with cards that were embedded with an EMV chip. This made payments far more secure by eliminating the need to use the easily replicable information that had been included on the magnetic stripe on the back of consumers’ plastic. At the same time the new chip-equipped cards came out, the industry could have also mandated that they be equipped to work with near-field communication (NFC), the technology that drives most contactless payments today. Failing to take this initial step probably cost years in the adoption of contactless payments.

The good news is that the United States is finally coming to a conclusion that most other developed nations have already arrived at: Contactless payments are fast, secure, and efficient. Add to that the fact that they are safe and can be used by anyone with a smartphone or the proper type of chipped credit card, and the verdict seems to be in: Contactless payments are here to stay – even in the land of the stars and stripes.

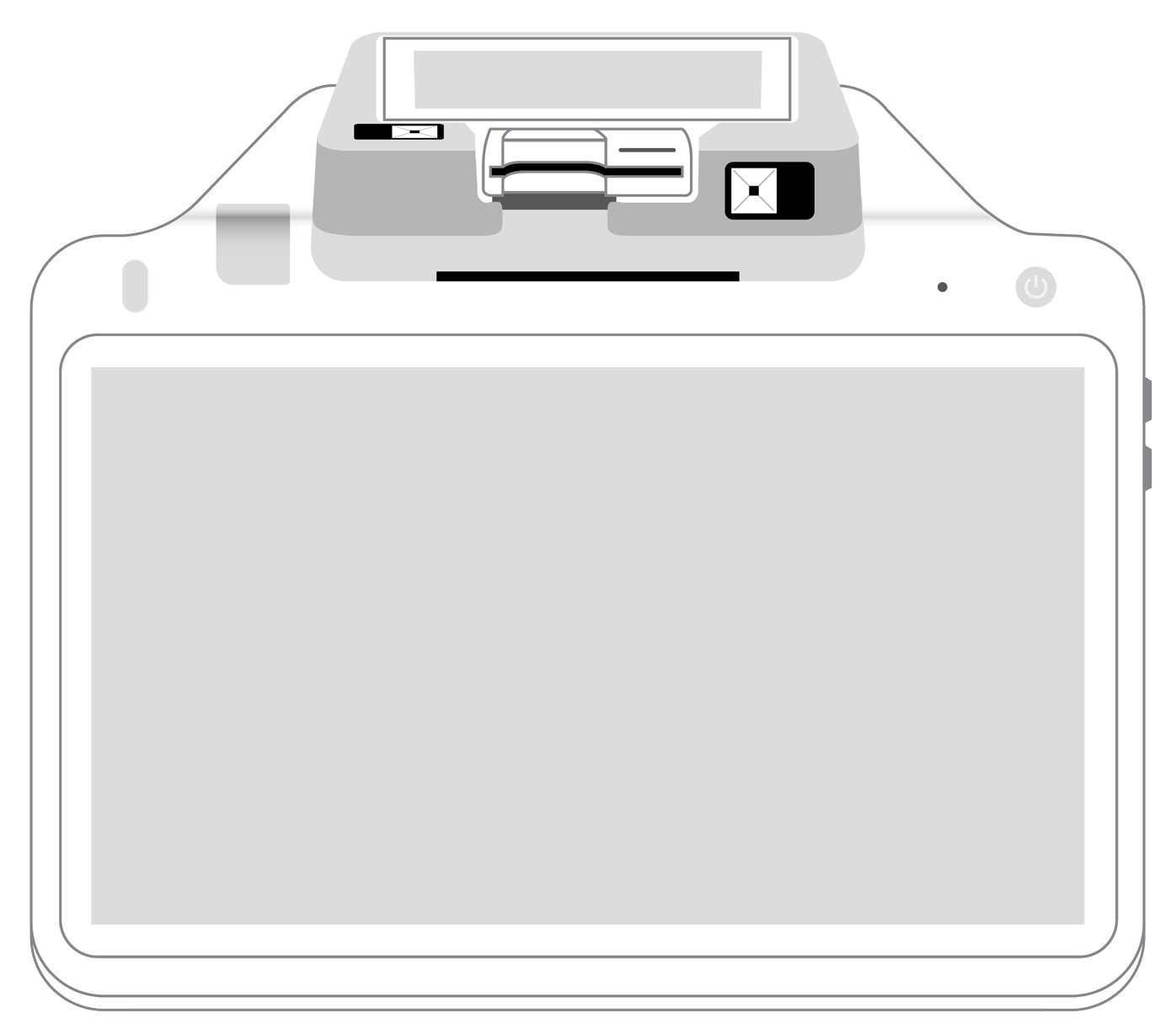

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||