Don’t take credit cards? Here’s what you’re missing!

Your business is missing out on a significant number of sales if you’re not equipped with a credit card reader. There are roughly 1.059 billion cards in the United States alone, and 60 percent of consumers report using plastic for purchases. Thirty-four percent use debit and credit cards “most of the time,” and 21 percent split purchases evenly between cards and cash.

Cash use is declining.

The growing preference for card payments is threatening the viability of cash-only businesses. Today, only 41 percent of American consumers carry any amount of cash regularly and one-third of all millennials rarely or never have cash on hand. Around 29 percent of U.S. adults don’t use cash at all during a “typical week,” so when customers come into your store, they are generally going to expect to be able to pay by debit or credit card. This is particularly true for larger purchases; only 20 percent of purchases of $25 or more are paid for with cash.

Rejecting cards hurts sales.

When customers discover your business doesn’t accept card-based payments, they’re likely to walk out and not come back. In fact, according to Finder.com, 73 percent of Americans will leave a store without making a purchase if there isn’t a credit card terminal. The other 27 percent are willing to go find an automatic teller machine (ATM) and return with cash, but the net result is a potential loss of 11.8 million customers for businesses without credit card processing equipment.

Accepting only cash also limits your customers’ spending power to the amount of money they have in their wallets. This limit disappears when they can use a card at the time of purchase and pay the bill later.

Cash flow gaps hurt your budget.

Cash and check payments must be deposited before the money can be pumped back into your business. The wait can be even longer if you invoice your customers and only accept paper checks. People prefer the convenience of cards and may wait until the last minute or even forget to pay you altogether! Accepting cards not only encourages faster payment, but also provides access to cash sooner.

Skipping fees doesn’t save you money.

Unless you run a very small business or low-ticket items make up the vast majority of your sales, avoiding credit card processing in an attempt to save on fees doesn’t make sense. You’ll lose much more in missed sales than you’d ever pay in fees. For example, if an average transaction at your business is $50, a typical industry-standard credit card processing fee would be around $1.50. Multiply the remaining $48.50 by the number of customers you could bring in by accepting cards, and you can see how diversifying payments is good for your bottom line.

If you want to attract more customers, encourage larger purchases, and reduce wait time on invoice payments, it’s time for your small business to start accepting card payments. A credit card reader with easy setup and user-friendly features will have you ready to start increasing your sales in no time.

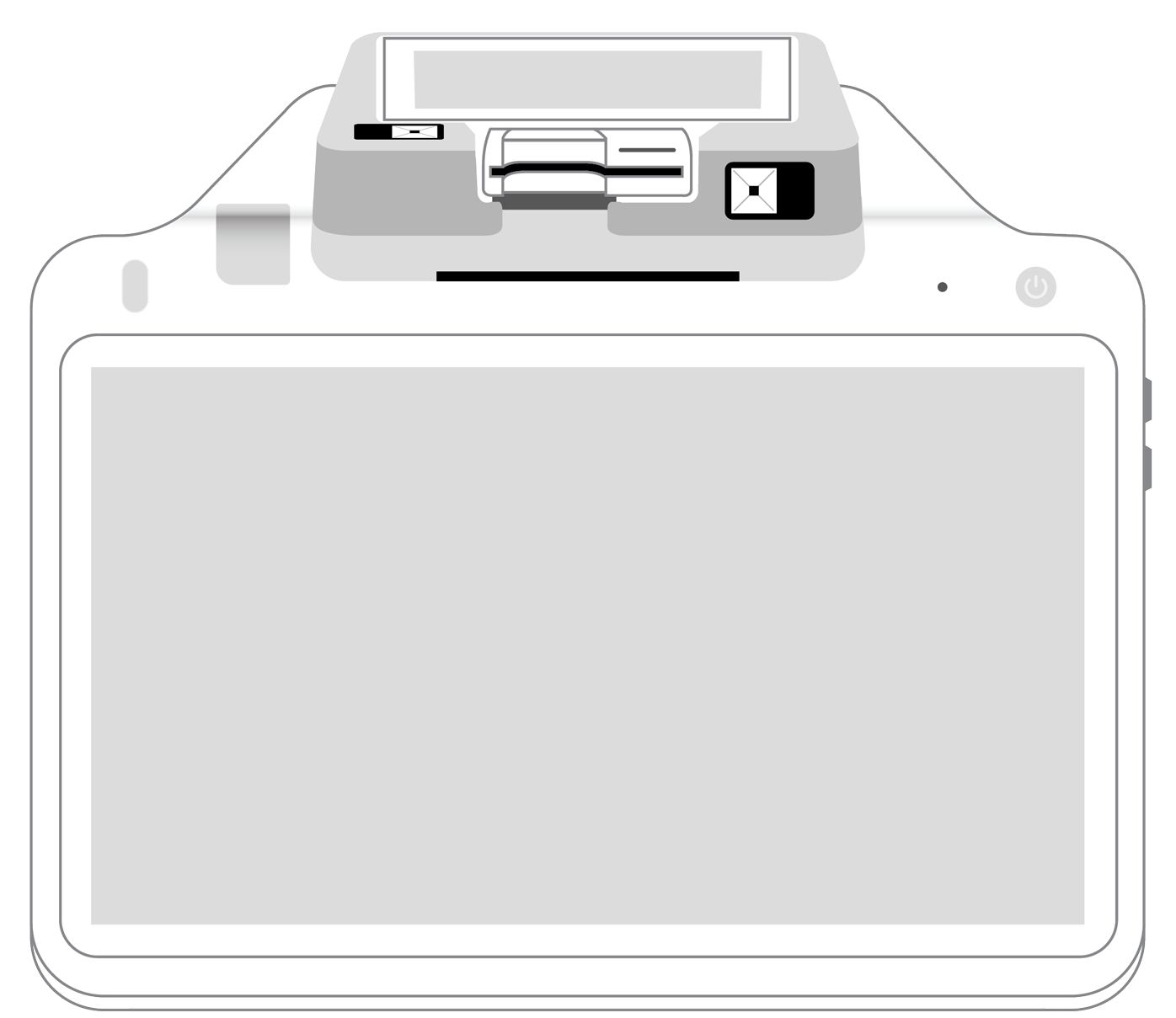

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||