Seven advantages of accepting credit cards online with virtual terminals.

Nowadays, customers value convenience, choice, security, and affordability in equal measures. Paying for products and services is no longer a simple hand-to-hand transaction of cash or even necessarily the swipe or tap of a credit card. In an era when it is vital for businesses to offer a variety of solutions that remove friction to make exchanging money for goods and services easier, merchants need to remain as nimble and flexible as possible at all times. Fortunately, credit card processing companies have recognized this priority, resulting in new solutions for ecommerce payments. For some retailers, incorporating virtual terminals into their business models is an essential way to expand and address their customers’ needs.

What are virtual terminals?

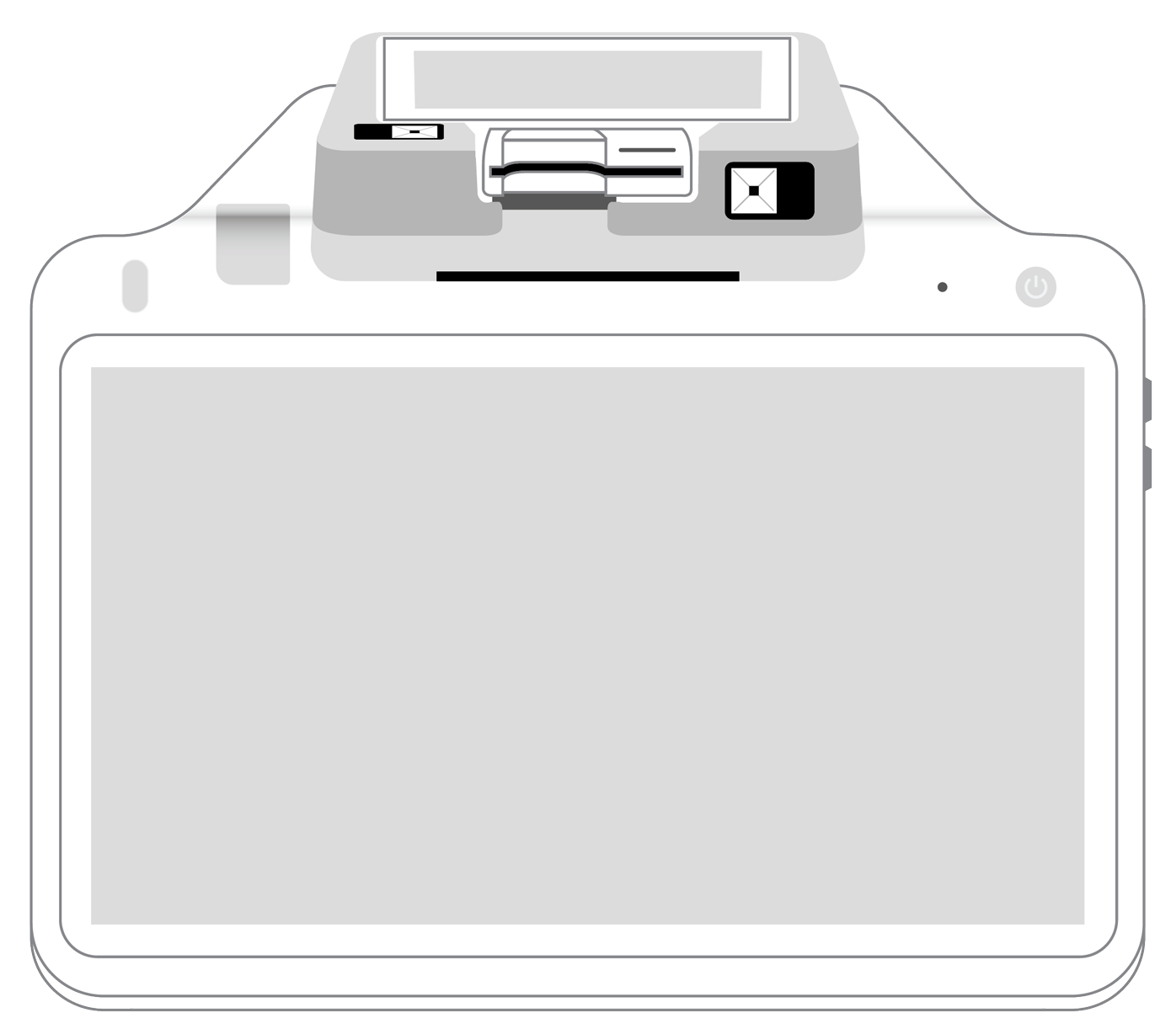

Before we embark upon a discussion of their advantages, it is important to understand what a virtual terminal does and what types of companies it best serves. Simply put, virtual terminals are the web equivalent of a standard point-of-sale (POS) solution. A brick-and-mortar retailer uses a POS to transact customer payments by swiping (for traditional magstripe cards), dipping (in the case of EMV chip cards) or tapping via NFC contactless methods like Apple Pay and Samsung Pay. Many of these physical POS solutions also provide a wide variety of supplementary services that streamline numerous business-related processes.

A virtual terminal performs many of these same functions. The difference is that you, the merchant, are the one who enters the buyer’s data into a web-based form on behalf of the customer, after which the information is processed securely just as it would be with a physical POS. The procedure works like this:

- You obtain the customer’s credit card or ACH data, generally via email or over the phone.

- You open your internet browser and log into your secure virtual terminal.

- You key in the customer’s payment data.

- You send the transaction for approval.

- You and all other relevant parties receive notification that the transaction has or has not been processed successfully.

Are you wondering whether it makes sense to incorporate a virtual POS terminal into your company’s business model? The best way to decide is to first learn about the advantages this equipment can bring to your day-to-day and long-term operations.

Low initial cost.

If you have ever set up a physical POS system in a brick-and-mortar store, you probably already know that doing so can be expensive. For many business owners, this experience involves a steep learning curve: conducting research about various hardware terminal and card reader options, training staff in their use, and troubleshooting when problems arise. By contrast, credit card processing companies charge very little to get you going with virtual terminals. The systems are generally intuitive and require little introductory training. For entrepreneurs who are operating on a very low initial budget, this cost savings and ease-of-use offered by a virtual terminal are often quite appealing.

Log in from anywhere.

A standard, old-school POS is a stationary device that is usually located at your checkout counter. In order to gain access to its features, the user is tied to this particular set location. The same is not true of virtual terminals. As long as you have access to your login information and password, you can make a sale or check on reports from anywhere at any time with the use of a laptop, smartphone, or desktop computer. In today’s fluid society, this flexibility can enable you to respond to opportunities and react to emergencies as soon as they arise.

Provide access to multiple users.

While security should always be a priority and you must be careful about access privileges, virtual terminals enable you to let all of your trusted staff members utilize your POS solution from anywhere. In addition, numerous people can do so at the same time, enabling collaboration and cutting down on the possibility of errors and misunderstandings that can happen if the information is made available to different parties at different times.

Reduced maintenance concerns.

As with any physical or virtual equipment that you use in your business, it is crucial that you ensure that your virtual POS terminal program receives regular upgrades. However, since this type of POS uses no hardware, you will never need to purchase updated physical equipment. In terms of the web-based software that runs the virtual POS terminal, it should be regularly upgraded by your POS provider. This vendor is also responsible for ensuring that it is secure and meets payment card industry data security standards (PCI DSS).

Ability to process recurring payments.

Once mostly favored by fitness and weight loss centers, the recurring or subscription-based payment model is now embraced by a wide variety of companies — and for good reason. It enables both merchants and their customers to know exactly when and how often a specific amount of money will be deducted from the client’s account and deposited into that of the business owner. Unlike physical POS configurations, virtual terminals make it possible for you to set up and modify these arrangements. The result is transparency, predictability, and a more predictable and reliable cash flow.

Streamline business operations.

Although the startup costs of virtual terminals are low and maintenance is a breeze, that doesn’t mean that these systems do not possess many of the same robust capabilities of their physical POS counterparts. If you think that a POS is nothing more than a fancy cash register, you are missing out on the numerous added gifts that your system can bring to your company. Let’s take a look at some of the most important:

- Inventory management tools. These capabilities allow you to have constant access to your library of products. In real-time, you can track what items are running low so that you never are in the unenviable position of running out of the best selling items your customers want.

- Reporting. With just a few clicks, your virtual POS terminal can provide you with crucial information that allows you to run your business more intelligently. Well-organized and readable diagrams can instantly provide you with information such as what products are moving the fastest and which employees are selling them. You’ll also easily access data about returns, chargebacks, and end-of-day, weekly, or monthly progress statements.

- Employee monitoring. When you and your staff are on the same page when it comes to roles and responsibilities, your entire business will run more smoothly. Your virtual POS terminal gives you the ability to assign varying levels of permission and access to each of your staff members according to their unique job descriptions, e.g., managers, cashiers, administrators, etc. For each of these individuals, you can determine the level of access they have to your entire POS environment, including privileges for logging in, product checkout, accepting returns, and updating stock counts. In addition, the system can take charge of scheduling, which may involve tracking hours, declaring tips, and emailing the specific calendar to each worker. Furthermore, you can easily track how well individual employees or groups are doing in terms of sales volume and payment method.

Benefits many nontraditional companies.

Some settings demand that sellers have physical POS terminals. For instance, brick-and-mortar merchants are expected to provide their customers with a direct payment process that does not give the retailer direct access to any of their sensitive credit card data. In traditional situations such as this, buyers simply dip ro swipe their physical EMV card into the merchant’s reader; the card never leaves their possession. Alternatively, they may place their phone near an NFC contactless device, whereupon the payment is processed via their digital wallet.

However, your company may not fit into the format of these traditional payment methods. For instance, a growing number of retailers conduct most or all of their orders over the phone or through email and do not have a physical location. Some specific sellers that gain from virtual POS terminals include the following:

- Service-oriented companies such as pet groomers, landscapers and tax preparers.

- Home-based businesses with no direct contact with customers.

- Companies that take their products and services on the road and to trade shows, flea markets, etc.

Because of their flexibility and scalability, virtual terminals are quickly becoming the go-to payment acceptance solution for many companies. With careful research, a savvy business owner can find a virtual option that is PCI DSS-compliant, offers excellent customer service, can be upgraded to meet changing needs and accepts payments of all types. Once this versatile software option is in place, you can expect a streamlined payment solution that serves your needs and those of your customers with a compelling combination of power and simplicity.

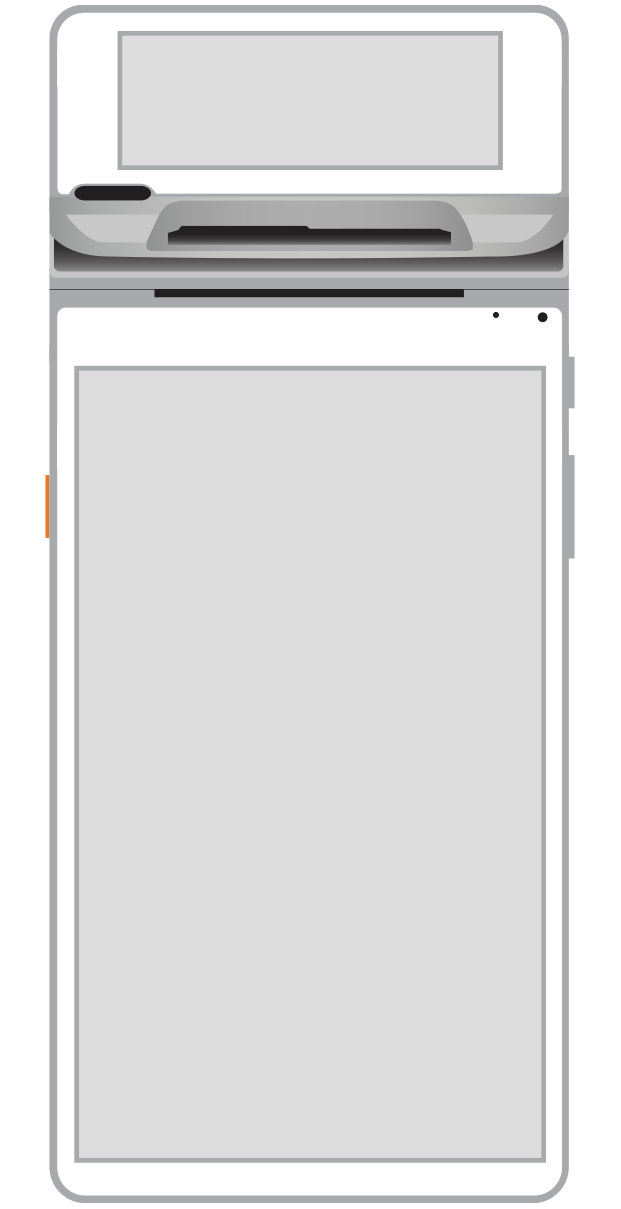

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||