What forms of payment should your business accept?

A good problem to have as a business is how to accept various types of payments from your customers. Let’s take a look at the main types of payments that are common for most businesses today.

1. Traditional cash and checks.

Any business with a storefront will want to be able to accept these more traditional types of payments. They essentially come with no complex accounts on the banking side. You simply need a business banking account so you can make deposits and withdrawals.

You will want to keep track of sales made by cash or check with your computer system. After all, you’ll need documentation for the sales when tax time comes around. Most businesses keep a ledger along with saving their banking receipts throughout the year. Many customers still appreciate a simple cash or check transaction, so be sure to keep this option available to your merchants.

2. Credit and debit cards.

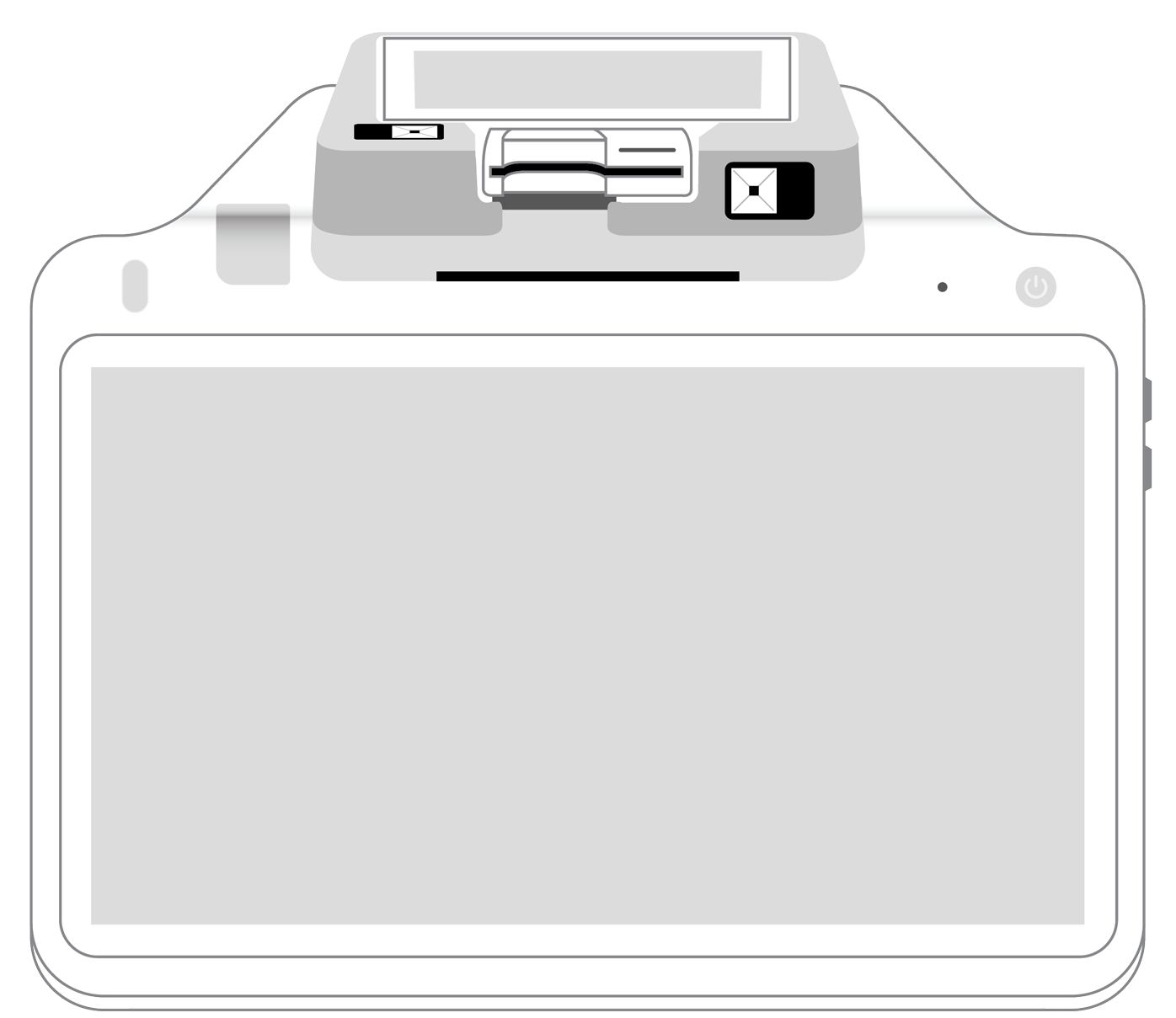

Today, a business cannot thrive without accepting credit and debit cards. The majority of consumers use these cards to purchase nearly everything. Businesses must set up merchant accounts in order to process these transactions. Keep the traditional countertop credit card terminal at your business, but also consider adding a wireless card reader. If you're ever out and about on business, these readers give you a quick-and-easy way to complete transactions on the go.

3. Third-party processors.

In today's virtual world, accepting payment through third-party processors, puts you on the business map. Many consumers prefer to pay through these channels, because they will shield them from fraud. A consumer links their bank account with the processor, which in turn, provides him or her with a new account through the vendor. This account is used to pay a business without revealing any of the consumer’s sensitive banking information.

Consumers may feel more comfortable paying through these services, which only require an email address and password to access the account and complete the transaction. Some of these processors even offer cards as another transaction option. Keep a wireless card reader handy at your storefront for servicing these savvy customers.

4. Digital-wallet services.

Many consumers are turning to smartphone apps as a way to bank and purchase items. They simply swipe their smartphone in front of a scanner to purchase your goods or services. You’ll want to be open to accepting these forms of payment because they're becoming increasingly popular. There are many phone apps, including Apple and Discover, that have these options.

As a business, setting up transaction acceptance through digital wallet services is often as easy as opening an account yourself. It sets you up to take these payments with ease, which essentially function like direct debit transactions between bank accounts. Consumers appreciate versatility with these digital wallets, so it’s important to keep up with the latest technology to stay relevant.

By making payments fast and frictionless for your customers, you’ll help create repeat business in the future. Continue to accept as many forms of payments as possible, as doing so will help your business stand out in the cluttered marketplace.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||