Why COVID is forcing consumers to adopt contactless payments at a faster rate than predicted.

So small that it cannot be seen with the naked eye, yet so deadly that it has fundamentally changed countless aspects of our society, the coronavirus is radically transforming our world. As a direct result, we are working, learning, and purchasing in new ways. As a result, shopping might never be the same again. Even the methods we use to pay for goods and services have undergone a seemingly instantaneous transformation.

In addition to making us conscious of breathing the same air and potentially transmitting infection by talking, singing, or attending events with large groups of people, the virus is causing us to rethink how (and to what extent) we touch the things, and people around us. While disposable gloves were mostly worn by medical and maintenance personnel before COVID, it is not uncommon to see shoppers sporting them in the grocery stores, at the gas station, and at the mall. Taking this extra precaution enables careful consumers to come in tactile contact with merchandise and other items. Then, they may simply throw away their handwear with reduced fear of contracting the virus.

While gloves can also be used when shoppers swipe or insert their credit card into your card card readers, this is not the only way to add an extra layer of protection. These days, NFC contactless payments, long touted by the industry as the wave of the future, are gaining popularity with conscientious customers because they fill a need. Thanks to modern technological advances, buyers can use their smartphones or chip-enabled credit cards to complete their purchases with minimal contact or fear of COVID transmission.

What are contactless payments?

There are two basic contactless payment options. The first involves using a mobile phone equipped with a built-in digital wallet. In order to use this method, the consumer must take the time to input payment data from their card or cards of choice, including card numbers, security codes, and expiration dates. That information is then securely stored in the digital wallet and can be used in conjunction with fingerprint or facial identification, as well as the merchant’s contactless reader, when the time comes to make a purchase.

The other type of contactless payment option is used by consumers who have plastic or metal credit cards into which a special payment chip is embedded. As with the digital wallet and smartphone type, these transactions can only occur if the merchant has an updated reader that is equipped with near-field communication (NFC) technology. When the time comes to buy, a consumer simply places the card near the reader, and the remainder of the process takes place nearly instantaneously behind the scenes.

An additional advantage to NFC contactless payments.

It is undeniable that reducing a person’s direct physical contact with surfaces helps to lessen the chances of picking up germs and viruses. However, that is not the only advantage that contactless payment options offer to today’s buyers and merchants. In fact, the extra security that they provide may be just as important.

When a consumer puts their credit card or smartphone near an NFC-equipped reader, a single-use token bearing the consumer’s encrypted payment information is created. Because it cannot be utilized more than once, the buyer’s private information remains safe from identity thieves and other criminals. In addition, consumers who use digital wallets can also count on the extra security layer of entering their PIN or biometric data before the transaction can take place.

In the past, concerns have arisen about hackers “skimming” the data on your credit cards simply by coming within close proximity to you. The good news is that a thief would actually need to get within four to 10 centimeters of your wallet to even have a chance of pulling off this stunt. Since payments are now tokenized, and many consumers are beginning to leave their plastic at home in favor of using the digital wallet in their smartphones, the likelihood of this happening is quite low.

Should you adopt NFC contactless payments for your small business?

As we have stated, the coronavirus has led many a merchant to answer this question with an unqualified “yes.” After all, anything that you can do to make consumers feel comfortable about buying your products and services is highly recommended at a time when so many companies are going belly-up due to the virus.

However, with budgets tighter than ever and the very survival of your business possibly at stake, you might be wondering whether it makes practical sense to spend the dollars it will take to upgrade your point of sale system. The good news is that if you have a modern system, it might already be capable of accepting NFC contactless payments. Before you do anything else, check the user’s guide that came with the equipment, or alternatively, consult with the credit card processor who provided you with the machines.

Even if your current terminals are old, you might find that upgrading is not nearly as costly as you had feared, especially with free placement options. In addition, the cash you need to put out now will probably be recouped many times over via the numerous advantages that a modern POS can bring to your business. These include inventory management, invoicing, and accounting tools, in addition to the safer NFC contactless checkout that so many of today’s customers are coming to expect.

How to incorporate contactless payments into your business.

Are you reluctant to take the contactless payment plunge because you’re a bit squeamish when it comes to adopting new technology? There’s no need to worry. In fact, accepting contactless payments is quite easy.

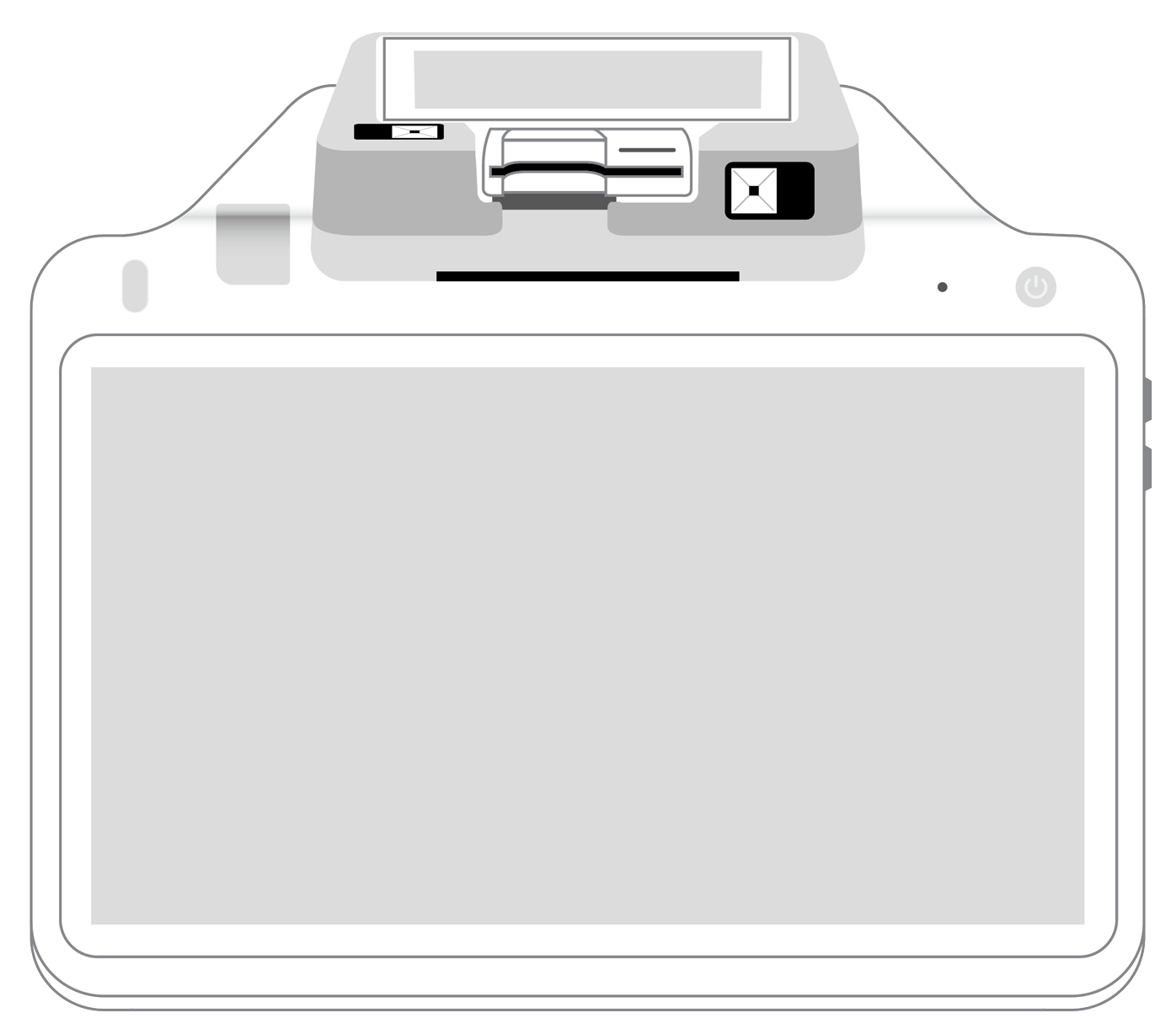

If you are using Bluetooth, first connect your POS tablet or smartphone to your card reader. Find the item to be purchased in your product library or enter it manually, select or input the price, and click the “charge” icon.

Ask the customer to tap their smartphone, watch, fitness device, or smart credit card on the reader. Then, they simply follow the prompts that appear on the screen of your POS system. At this time, you may request a customer’s email address to either print them out a hard copy of the receipt, or send it via text or email.

Habits die hard.

Many of us are slow to change, but we are equally reluctant to regress to old behaviors once we have switched over to new ones. For this reason, it seems likely that the strategies that consumers have adopted to lower their risk of contracting COVID-19, including using touchless payments, will continue to be popular even after the pandemic is in our rearview mirror.

In a world where the coronavirus remains a threat and the next pandemic seems to lurk just around the corner, NFC contactless payments seem to many consumers to be a much cleaner and safer way to do business. Combine that with an increased trend among merchants to provide this service and it appears likely that contactless payments are not only here to stay, but may even soon become the purchase method of choice for most consumers.

Still on the fence about whether you should offer this touchless purchasing option to your present and future customers? Consider taking the following actions:

- Ask current consumers how they feel about contactless payment options. Would they prefer to use them when buying your products?

- Get in touch with your payment processor to learn if your current POS equipment accepts NFC contactless payments.

- If it does, inquire if you can receive instruction on how to incorporate this technology into your business?

- If you need an upgrade, do your research to find POS terminals, readers, receipt printers, etc. at an affordable price.

- Shop around until you find a company and a price point that meet your needs.

The coronavirus has rocked virtually every aspect of our modern world. In a strange way, the accelerated use of contactless payments might be one of the few bright spots this international pandemic has brought about. After all, the value of speed, added security, convenience and safety cannot be overstated.

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||