Are You Keeping up With How Customers Want to Pay?

The importance of optimizing the payment experience of your shoppers is essential. That’s why it is vital to understand the buying methods that modern consumers want to use as well as their payment priorities.

Top payment trends in 2025

Two factors have been instrumental in the evolution of today’s payment trends. First, burgeoning technologies have led to enhanced convenience and data security. Second, the after-effects of the 2020 pandemic continue transforming the purchasing landscape.

1. The rise of contactless

The pandemic was responsible for creating some shopping trends and accentuating others. One that fell into the latter category was contactless payments, which were jump-started when hygiene became crucial and people sought a touch-free way to interact with merchants’ point of sale systems.

While COVID’s worst impacts have subsided to a great extent, its effects remain palpable, including the ongoing popularity of contactless iPhone Tap to Pay.

In fact, more than six out of every 10 in-person transactions are predicted to be contactless by the end of this year. At this astounding rate, the global number of these touchless payments is estimated to climb to $15.7 trillion by 2027.

Technological advancements have been just as important as the recent health crisis in propelling the rise of payment innovations. A case in point is the digital wallet, which securely stores customers' payment details in their smartphone or wearable device and enables them to seamlessly authenticate their identity and complete a purchase.

The popularity of digital wallets is undeniable. There are over 3.4 billion digital wallet users globally. Each month, 65% of U.S. adults take advantage of the speed, security, and convenience of this touchless electronic option.

2. Credit cards

Although other purchasing methods have catapulted onto the scene, credit cards remain a mainstay of the industry. Recent statistics bear out this contention.

Currently, there are over 800 million credit cards in circulation in the United States, with the average American holding 3.9 of them in their “real” or digital wallet.

Paying with plastic has staying power even with today’s tech-savvy customers because this purchasing option is so versatile and convenient. Moreover, modern cards are evolving to remain at the vanguard of the most advanced security protocols.

This may account for the recent uptick in household credit card spending that has been seen over the past year.

3. BNPL (Buy Now, Pay Later) options

In uncertain economic times, customers looking to make larger purchases are very receptive to using alternative payment options such as Buy Now, Pay Later (BNPL).

This method involves customers partnering with services like Affirm, enabling them to delay payments or divide them into more manageable chunks. A recent report showed that 41% of U.S. adults have taken advantage of BNPL in the last year, with another 22% stating that they would be likely to do so in the future.

In no demographic is acceptance of BNPL more profound than for Gen Z shoppers. With traditional credit harder to obtain and maintain than ever, younger buyers are embracing alternative ways to pay, including BNPL.

Whether it is out of preference or necessity, a staggering 27% of Gen Z buyers would forgo their purchase altogether if BNPL were not offered by the retailer.

What do customers want?

Providing a premium shopping journey at all touchpoints requires attention to current trends as well as an understanding of each customer. When you emphasize intelligence and personalization, you can furnish the journey that sets you apart from your competitors.

Flexible payment options

When you run an ecommerce site, your first victory occurs when a shopper chooses merchandise and places it in their online shopping cart. However, if they abandon that cart without completing the sale, all of your hard work amounts to nothing.

While you can’t prevent every instance of shopping cart abandonment, you definitely can do something about it. An estimated 10% of shoppers click away without buying because you have failed to offer a choice in payment options. Devote some time and energy to learn your customers’ preferred payment methods, and then configure your systems accordingly.

Making the financial burden of product costs lighter is turning out to be one of the most effective ways to turn views into purchases. BNPL allows for costs to be broken down into more manageable chunks. Moreover, it is an excellent option for customers who do not possess an established credit card or have a lower credit score.

When your company provides a variety of payment choices, you demonstrate to potential buyers that you care about what is important to them. You also bolster your business’s credibility by showing that you partner with established entities and are willing to accept money from bank transfers and digital wallets.

Security

Online businesses require their customers to take a huge leap. Without ever personally meeting you or physically interacting with your products, shoppers must be willing to send their money into the electronic void.

It’s no wonder that almost one in five people who abandoned their carts said they did so because they did not trust the website. This underscores how important it is for you to create the best possible online presence. Prioritize elements including ease of navigation, mobile friendliness, transparency, and access to customer service to foster this all-important consumer faith.

Additionally, you can increase your chances of conversions if you only ask the minimum from your customers. For instance, avoid gathering more financial or personal details than is absolutely necessary. Let shoppers complete their purchases as guests if they choose to do so. You can still incentivize them to create a permanent account later.

The reality is that today’s customers have mixed feelings about online shopping. While SOTI reported that 64% of those surveyed valued a personalized ecommerce experience, an even higher 76% remained fearful.

With this dichotomy in mind, business owners should do everything they can to strengthen their online safety protocols. Make it a point to show your customers how you are living out your commitment to data security.

Convenience

While protecting their sensitive payment details is at the top of most customers’ lists of priorities, the element of convenience is just as important. Yes, harried multitaskers want a safe way to make their purchase, but they also want it to be fast and easy.

A recent report indicated that cash, once king, is not as preferred as it once was. In fact, 9.6% of customers find paying with bills and coins to be less convenient than doing so with a credit card.

Another popular way to pay has become the digital wallet. This method only requires that the buyer pre-load the wallet app on their smartphone with their payment details. At the time of purchase, they simply open the app, authenticate their identity via Face ID, fingerprint or PIN, and complete the transaction quickly and securely.

People seem to love digital wallets: 80.6% of U.S. Digital wallet users prefer them for their speed, and 76.9% cite their overall convenience.

The self-serve kiosk also seems to be enjoying an upsurge. 11.9% of the people surveyed actually prefer to DIY their entire buying process, a shortcut that leads to a fast purchase and shorter lines at the traditional cash register.

The same report shows that 11.9% of the people surveyed actually prefer to DIY their entire buying process. This shortcut leads to a fast purchase and shorter lines at the traditional cash register.

Embed This Infographic

Copy and paste the code below to get this infographic onto your website or blog.

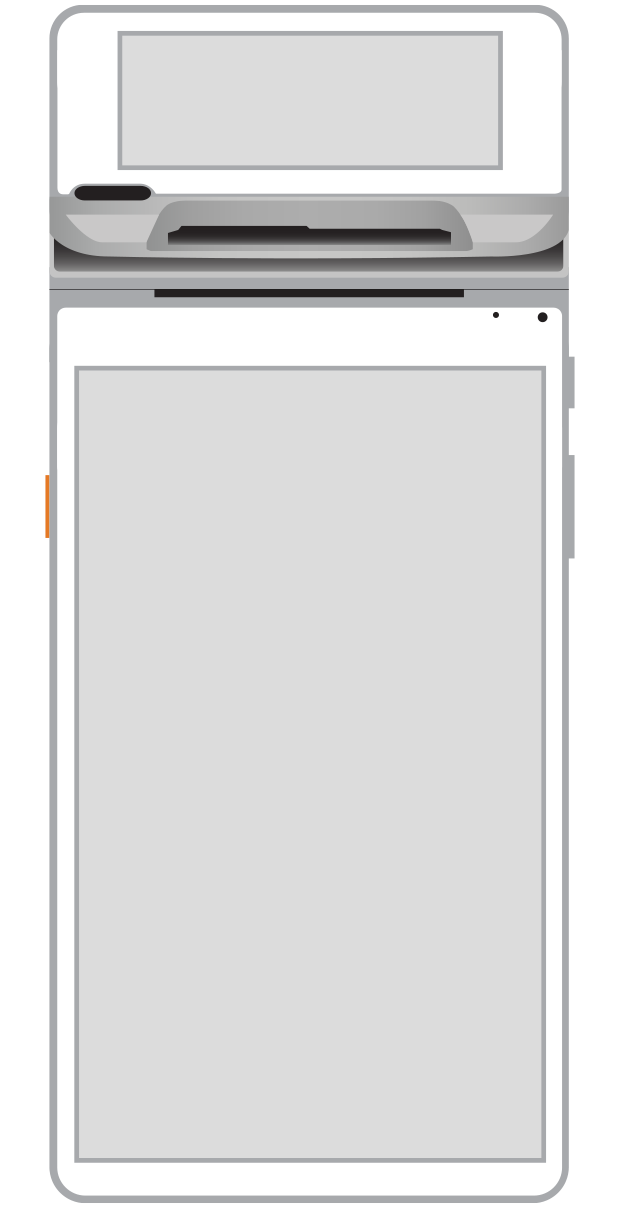

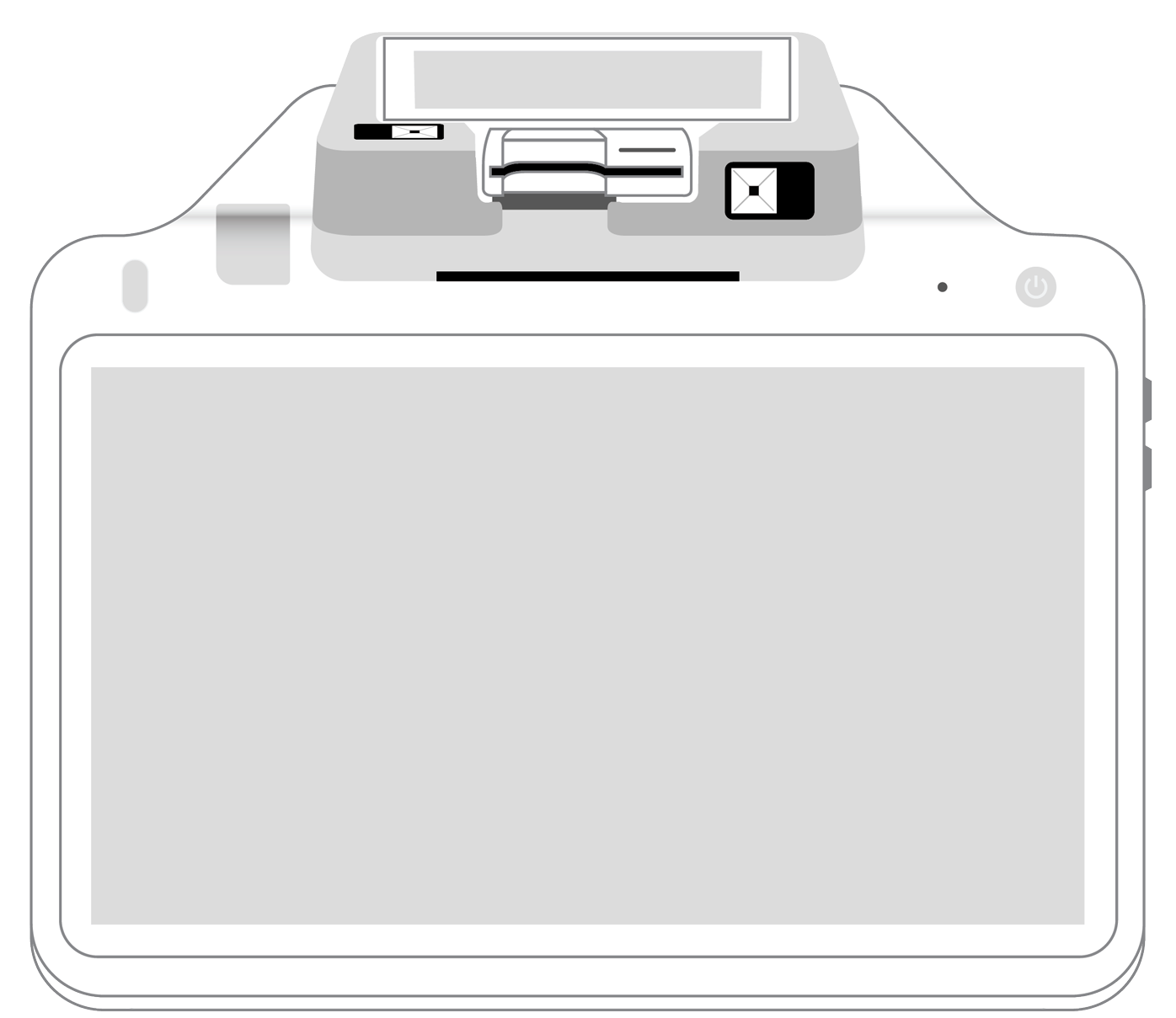

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||