5 ways contactless payments can benefit your business.

When you’re busy running a business, the prospect of making any sort of change in your infrastructure can seem daunting. Unfortunately, this “if it isn’t broken, don’t fix it” mentality can leave you lagging behind your hungrier and more adventurous competitors. The good news is that one of these modifications, upgrading to a contactless card reader, is easy, affordable, and highly effective while simultaneously appealing to your customers.

What are contactless payments?

This is where a simple guide to touchless payments can come in handy. This fast, frictionless, and safe payment method relies on the near-frequency communication (NFC) technology that is embedded both in the customer’s card, smartphone, or wearable device, and in your contactless card reader. Fortunately, understanding contactless payments doesn’t require a Ph.D. in computer science. Here are a few details.

- The customer must have either a chip-enabled credit card, or have set up the digital wallet on their smartphone. (This involves preloading it with card payment details.)

- At the time of purchase, the buyer places their card, wearable, or phone within two inches of the merchant’s contactless reader.

- The antennas in the two devices communicate with each other, allowing for the fast and secure transmission of payment details to the processor for approval.

Within a matter of seconds, the transaction is complete. It’s no wonder that businesses are recognizing the benefits of contactless payments. Let’s take a look at just five of them.

1. Greater speed.

Long lines at the checkout counter are frustrating for everyone, including your staff. With touchless payments, transactions are completed much faster and with less fumbling for change or checks. You might even find that you can free up one or more of your associates to take on other tasks in the store when your checkout lines move faster.

2. Enhanced security.

When payment information is left vulnerable to hacking, both buyers and sellers suffer. The good news is that contactless payments are clad in the armor of certified, point-to-point encryption and military-grade tokenization. Although it might look like the payment is ripe for thievery, the fact is that it is not. This is because the numbers are converted into a single-use, random series of numbers that cannot be replicated.

As a result, data is kept safe from cybercriminals. This protects your brand and reputation and means that the seller is not viable in the unlikely event that a breach does occur. At the same time, the customer is not left carrying the cost burden that identity theft can cause.

3. Increased flexibility.

Contactless technology has many uses. Not only does it allow people to make payments with their cards and digital wallet-equipped smartphones, but also it works on wearable devices like fitness trackers and watches. As a result, shoppers can pay in a variety of ways, thus making the checkout experience simple and seamless no matter what they may have in their pockets or on their arms.

4. An elevated shopper experience.

These days when every penny counts and competition is fierce, it is vital that you do all you can to create a positive shopping journey for your customers that extends from the time they first browse online or in person until they complete their payment and beyond. Contactless transactions mean that your shoppers can pay safely, quickly, and in the way they want, without fear of data breach. Giving them access to this technology will also put you at the top of their list compared to competitors who have not upgraded their payments hardware in this way.

5. Intangible pluses.

In the past two to three years, shopper health and safety have come to the fore in numerous ways. Even long after it became clear that COVID-19 was not primarily transmitted by touching contaminated surfaces, buyers remained adamant about embracing solutions that minimized physical touch between themselves and merchants. When you add touchless payments into your infrastructure, you are sending the message that you care about your customers' well-being and are willing to invest in their safety.

Getting set up with touchless payments couldn’t be easier. In fact, your current hardware may already be compatible, with no need for any upgrades. Speak with your payment processor to get details specific to you, and you could be up and running with this popular and innovative technology in mere minutes!

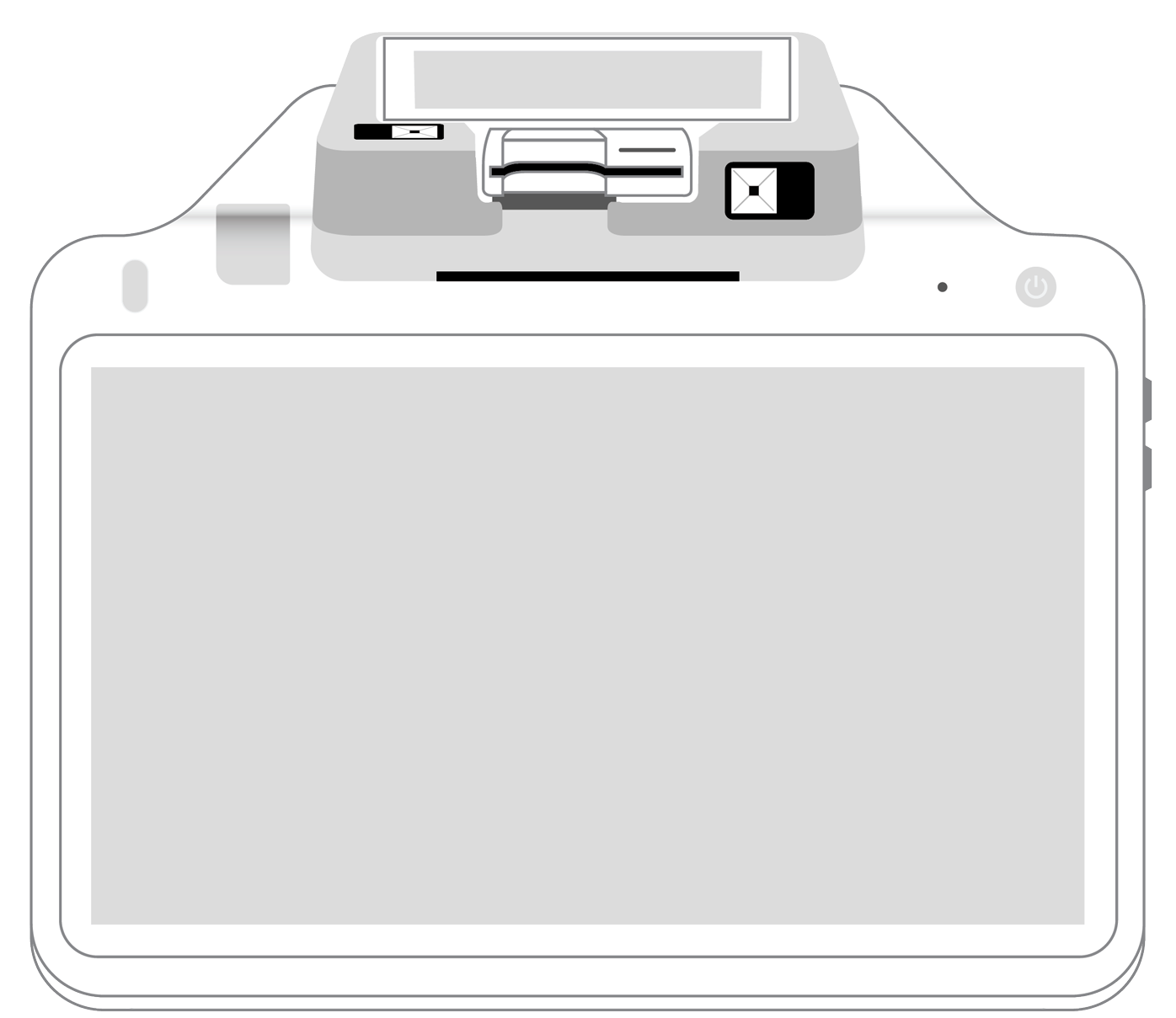

3-in-1 Reader |  Terminal |  Keypad |  PINPad Pro |  Flex |  POS+ | |

|---|---|---|---|---|---|---|

Payment types | ||||||

EMV chip card payments (dip) | ||||||

Contactless payments (tap) | ||||||

Magstripe payments (swipe) | ||||||

PIN debit + EBT | ||||||

Device features | ||||||

Built-in barcode scanner | ||||||

Built-in receipt printer | ||||||

Customer-facing second screen | ||||||

External pinpad | ||||||

Wireless use | ||||||

Network | ||||||

Ethernet connectivity | With dock | |||||

Wifi connectivity | ||||||

4G connectivity | ||||||

Pricing | ||||||

Free Placement | ||||||